With $359M funding in Q1 2023, Saudi Arabia beats UAE

While the overall funding in the MENA region dipped by 67% in the first quarter of the year, according to a Magnitt report, Saudi Arabia and UAE emerged as the top countries to raise funds in the GCC region.

Countries in the MENA (Middle East and North American) region saw $818 million in funding across 94 deals in the first quarter of 2023. This is half of the number of transactions seen in the same period in 2022, according to a report by Magnitt Research.

Like other regions, global macroeconomic factors including the ongoing Russia-Ukraine war, inflation, and higher interest rates affected funding in MENA in the first three months of the year.

The funding amount stood at 25% of the total funding deployed in FY 2022. Two mega deals in the Kingdom of Saudi Arabia (KSA)—flower delivery startup Floward and grocery delivery company Nana — and one deal in Egypt—fintech platform Hala—accounted for 67% of the region’s total funding.

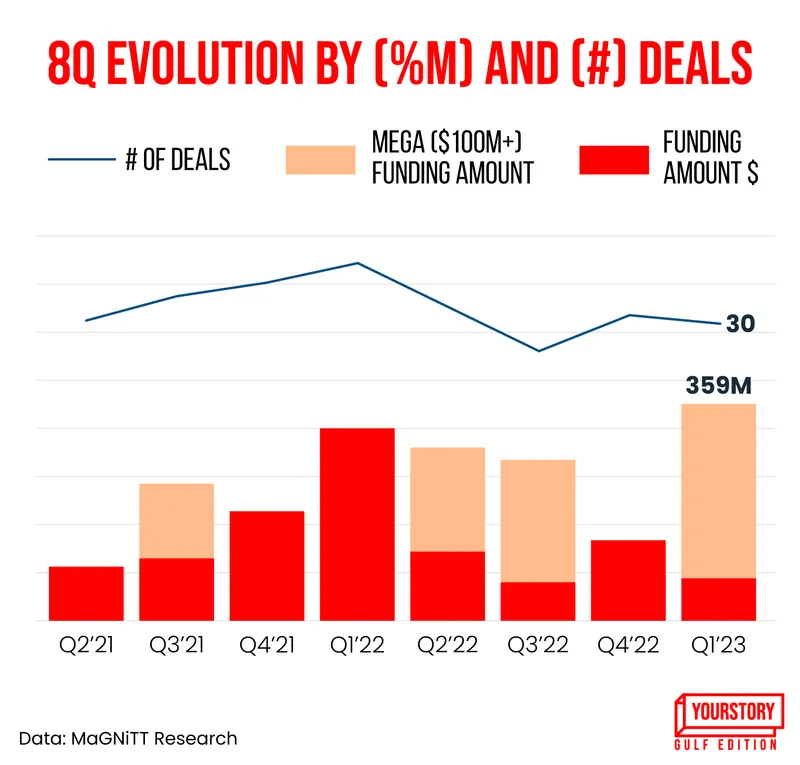

Interestingly, the funding raised by Saudi Arabia was at an all-time high at $359 million. About 89% of this came from two $100 million deals closed during February—Floward and Nana’s Series C funding.

UAE deals

KSA beats UAE

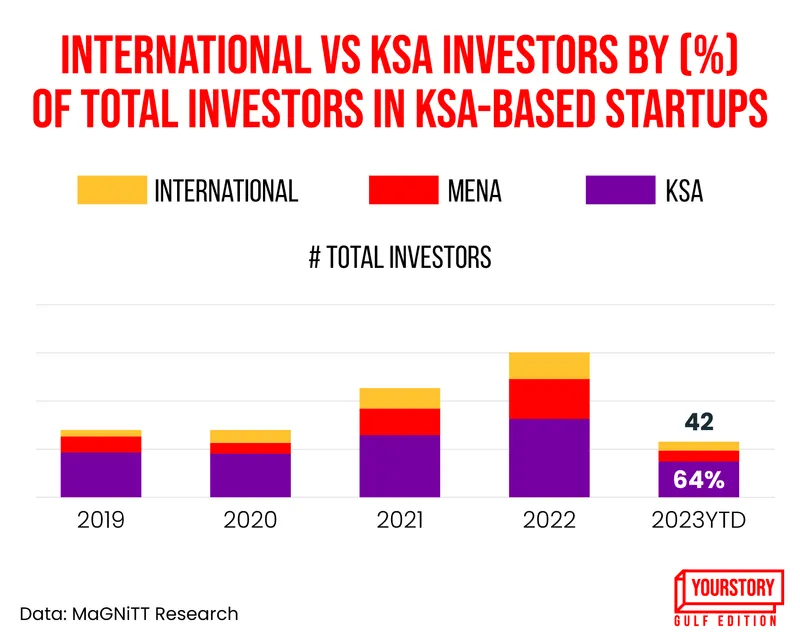

The rise in funding despite overall macroeconomic challenges highlights investor interest in the Saudi startup ecosystem. The country’s 8.7% GDP growth has also helped investor sentiment and acted as a buffer against tough macroeconomic conditions.

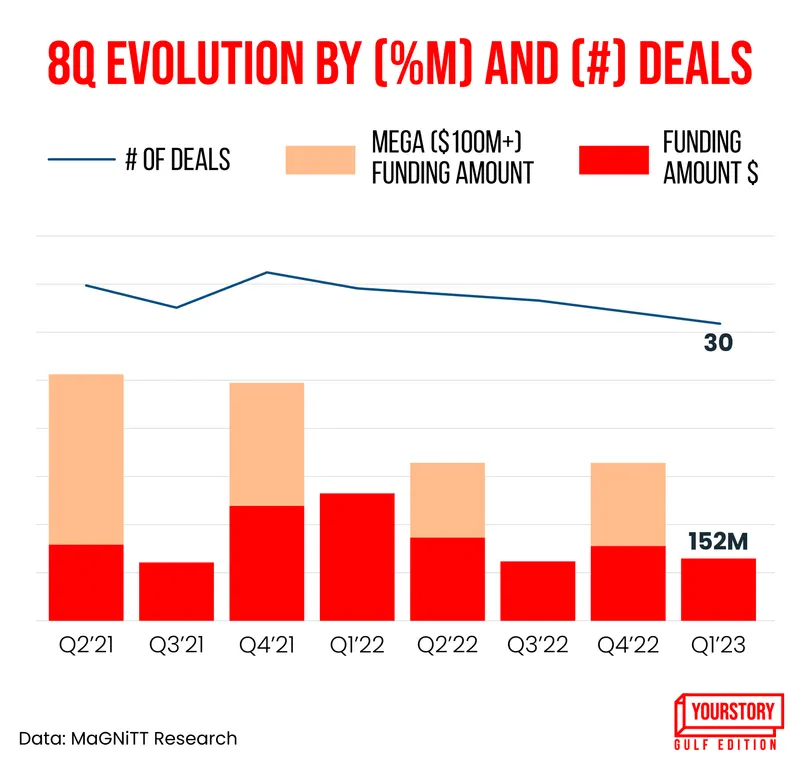

KSA accounted for 44% of the total capital deployed in the region. The UAE, while a close second in the GCC region, raised 150 million. Both countries are tied in terms of the number of deals at 30.

This time, the investors showed more interest in ecommerce and retail, as opposed to the usual favourite—fintech. Ecommerce and retail were the most transacted and highest funded industries in KSA. Three of the top 10 deals closed in 2023 were from the ecommerce and retail sectors.

The other favourites included—F&B, fintech, enterprise solutions, transport and logistics. Investors, however, believe that it is an interesting time to invest in KSA, as the Vision 2030 goal has accelerated significant development in the region.

KSA Deals

“This is across sectors—whether it is the growing number of women in the workforce, scalability, and the number of companies. We’ve got a history of being in countries where we were part of their growth journey from the beginning, and that is where we can be useful,” says Jonathan Ortmans, Founder and Chairman, Global Entrepreneurship Network.

“For instance, we can’t contribute much to Silicon Valley; we're much more in our element in emerging economies where we can bring knowledge, community and networks from across borders,” he adds.

Shrinking cheques

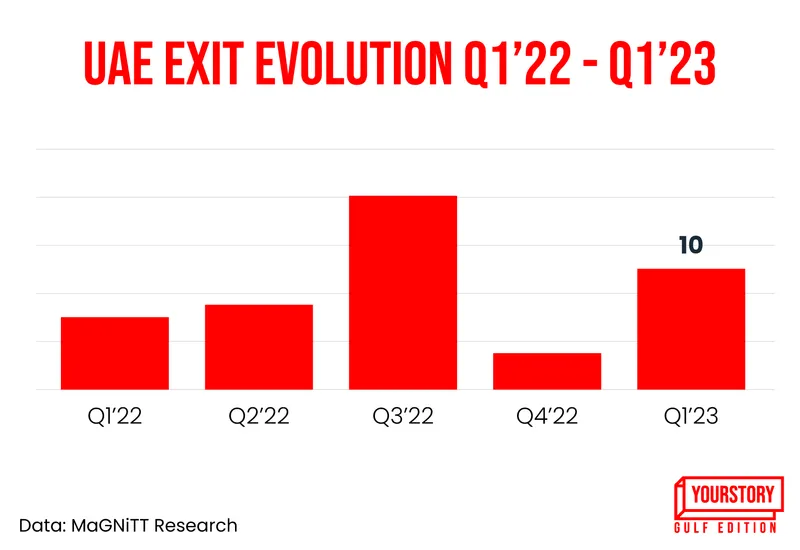

While UAE had lower overall funding, it held the fort when it came to the number of deals. Close to 60% of the total funding in the UAE was from the BNPL app Tabby, the dine-in payment app Qlub, and the online marketplace COFE. The three deals collectively raked in $100 million.

However, both UAE and KSA mirrored the overarching double-digit decline seen in the region. There was a 12% quarter-on-quarter decline in the total number of deals and a total of 60% in terms of funding. In the Q4 of last year, the region boasted of a sharp increase in funding, driven by the $200 million mega-deal close by the online classifieds platform EMPG.

This also is the fifth consecutive quarterly decline in the total number of deals in the UAE. This is also reflected in the month-on-month activity. February saw a 95% slump, marking the lowest for UAE since September 2020.

According to Philip Bahoshy, Founder, MagNitt, the overall picture for venture capital looks bleak, given that the US Federal Reserve raised interest rates again at the end of last month and some regional banks followed suit.

“There are reports of an abundance of “dry powder”, as per Pitchbook, global dry powder currently stands at over $550 billion. But, 2023 might just be about surviving, not thriving,” he writes in his newsletter.

Investors are likely to remain cautious in the near future and the ecosystem will see more valuation corrections. “Any signs of recovery in venture capital would only be seen towards the end of this year or the start of the next,” he adds.

(Images by: Winona Laisram)

For any press related queries or to share your press releases, write to us at

[email protected].

Edited by Affirunisa Kankudti