Micro-enterprises face the brunt of delayed payments, but what’s the solution?

Delayed payments represent a significant challenge for MSMEs, which frequently operate on tight margins and limited resources. A new measure was announced in Budget 2023, but experts believe other initiatives also need to be taken to resolve the problem.

Profit may be the marker of success for a business, but it is the cash flow that keeps the shutters open.

In today's business environment, with high valuations dominating the startup ecosystem, the importance of cash flow is often overlooked. Successive funding rounds often keep startups and large enterprises afloat, but the cash-poor nature of many micro, small, and medium enterprises (MSMEs) makes them particularly vulnerable to delayed payments.

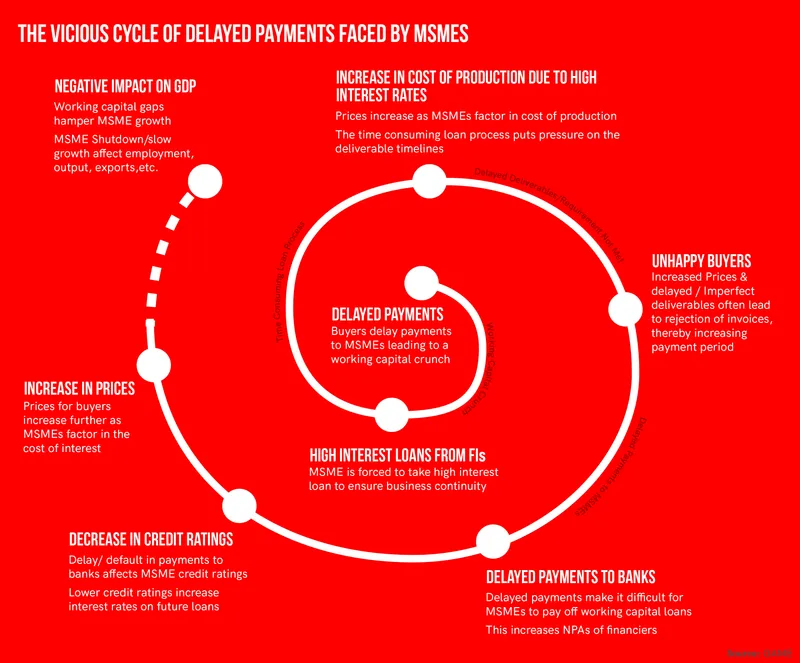

Delayed payments represent a significant challenge for MSMEs, which frequently operate on tight margins and limited resources. The issue poses a threat to the viability of these businesses, which are essential for supporting the broader economy where their contribution is almost 30%.

Keen to tackle the tenacious problem, Finance Minister Nirmala Sitharaman during this year’s budget announced that the government will allow expense deduction claims for buyers only when they make payments to suppliers. In short, a company can claim a deduction on an expense only if it has paid the supplier against that expense.

Speaking about the impact of the measure, DP Goel, Co-Chair, MSME Committee, PHD Chamber, says the step is great but might only help in 10% of cases.

“If the expense claim is not allowed by the government unless payment to MSMEs is made by the purchaser, this effect will be too slow. Who will certify whether the payment against a particular bill is released or not?” he asks.

In regular cases, payment is released in a lump sum; in other cases, it is linked with the performance of the product, especially engineering goods, which can take years. Goel says it is difficult to say if the measure will have much impact except in a few specific cases.

Image Credits: Nihar Apte

Green fuel, MSMEs, employment and skilling: Quick takeaways from Budget 2023

Solving problems but not directly

Long payment dues undermine an MSME’s ability to sustain business.

According to MSMED Act 2006, any buyer who fails to make payment to MSMEs, as per agreed terms or a maximum of 45 days, would be liable to pay monthly compounded interest at 3x the bank rate notified by RBI.

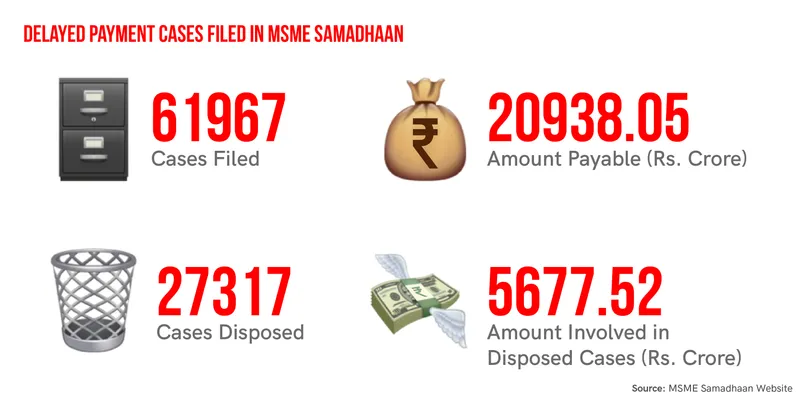

In 2017, the Office of DC (MSME), Ministry of MSME, came up with MSME Samadhaan, a platform where micro and small enterprises could file applications regarding delayed payments online. These applications are forwarded automatically online to the concerned Micro and Small Enterprise Facilitation Council (MSEFC).

As per the portal, from 2017 onwards more than 62,000 cases of delayed payments have been filed by micro and small enterprises, of which only 27,382 have been disposed of. More than 34,000 cases, amounting to about Rs ∼15,260.53 crore, are to be settled and micro and small business owners - despite the expectation of cash flow relief - are yet to receive significant benefits from the portal.

Vivek Bansal, a manufacturer and distributor of steel products based out of Kanpur, Uttar Pradesh, says he considered filing a case of delayed payment on the portal. However, the long turnaround time has deterred him and others from doing so.

Amit Kumar, Founder of MSMEx, a micro advisory platform providing business advisory and consulting services, highlights that only about 20% of all applications have either been disposed of, or mutually settled with buyers. Another 27% of total applications are currently under consideration while nearly 39% applications are yet to be seen by government officials.

“If we calculate, it will take nearly two to three years for these pending cases to be disposed of. The portal is stuck so how can business owners, who have limited cash in hand, rely on this solution?” Kumar says.

The solution of claiming a deduction against the expense might be fruitful, but the experts are apprehensive if it will solve the timely payment problem around the year.

Vivek Jalan, Partner at Tax Connect Advisory and Chairman of Fiscal and Taxation Affairs Committee—The Bengal Chamber of Commerce and Industry, highlights that since income tax is a once-in-a-year process, compliance with this provision would be checked only on March 31. This means there can still be delays during the year and customers would not get impacted in case they regularise the payments by the end of the fiscal year as per this provision.

Experts suggest the measure could work better if compliance is checked and reported on a quarterly basis when advance income tax is paid.

Image Credits: Nihar Apte

Emerging in Amrit Kaal: How MSMEs in 2023 will define the roadmap for Atmanirbhar Bharat

What’s the solution?

Madan Padaki, Co-founder of Global Alliance for Mass Entrepreneurship, says there’s a need for greater clarity on how this announcement would be implemented.

Stating that it will create pressure on MSEs lower down in the value chain in the short term, Padaki explains that for a trading MSME, suppliers sell them the required material for cash as these small payments are made instantly. However, the buyer who purchases products from the trading MSME would buy it on credit, which often leads to delays in accepting the invoice.

As per the definition of delayed payments, the delay is counted post the issuance of the invoice. Consequently, the trading MSME would be in the most vulnerable position in such situations.

Padaki feels “changing the definition a bit” could help. For calculating delayed payments, rather than considering the date of acceptance of the cheque, if the government considers the date of issuance of the cheque, some positive change could be witnessed.

Atul Puri, Advisory Board Member & Director-North of MSME Bharat Manch and Founder of eGrowth, a B2B network ecosystem for small and growing businesses, suggests that a redressal mechanism or rating system, similar to that used by companies such as Zomato and Uber, would benefit both buyers and sellers in the MSME ecosystem.

Puri feels a tracking mechanism that records the activities of buyers and sellers would enable them to make better-informed business decisions. A rating would help address the problem of delayed payments and create transparency in the MSME ecosystem.

Goel says the Micro and Small Enterprises Facilitation Council (MSEFC) should become more active in solving these cases.

“MSEFC should be given powers to block the bank account or GST of the defaulter party instead of referring the matter to civil courts. This will solve more than 80% of delayed payment problems,” he adds.

India has a total of 633.9 lakh MSMEs, of which 630.5 lakh – a whopping 99% of its MSMEs -- are micro-enterprises. This is the sector most vulnerable to the problem of delayed payments. A prompt and robust solution to address this issue is crucial to ensure that the growth engine of the economy continues to run smoothly.

Any further delay in resolving this problem could exacerbate the challenges faced by this critical sector, potentially leading to negative repercussions for the broader economy.

(Infographics by Nihar Apte)

Edited by Teja Lele