Has the music streaming industry gotten the Indian market wrong?

Streaming is the most popular medium of consuming music today. However, India as a market significantly differs from the west when it comes to music. This article explores how India is a different market segment and how strategies can be tailored to align with this market.

Source: loudest.in

About seven years ago, my then friend and current co-founder Aman and I had come up with a weekly Thursday ritual. This ritual was to visit a record store every Thursday and buy a Classic Rock album, listen through it on loop all week and come in the next Thursday again only to repeat this act. As you must have guessed it, our music collection grew with every passing week and Adagio, our musical brainchild, today boasts an enviable CD and vinyl collection. With the changing times however, I have snugly succumbed to the convenience offered by digital music and accepted the trade-off between owning physical albums and their intricate inlay artwork to paying a monthly subscription for accessing a humongous music catalogue.

The consumption of on-demand media is on the rise globally. According to Statista’s Digital Economy Compass 2018 report, the global digital media market is currently a $119 billion market and is expected to reach $146 billion by 2022. In the above figure, digital music represents a $12 billion industry in 2018, expected to reach $14.5 billion by 2022. According to IFPI’s Global Music Report 2018, the highest share in music revenues in 2017 came from digital streaming services – 38% of the total revenue (excluding digital sales). Total streaming revenue saw 41.1% increase from the previous year and the number of paid subscribers by the end of 2017 reached 176 million users of which 64 million were added in the same year.

Not so surprisingly, India too, appears to be a growing contributor to the above figures. In a recent study carried out by Deloitte, the number of online music users (both free and paid) in 2018 are 137 million and are expected to reach 273 million by the year 2020. Given the penetration of smartphones and the improving internet speeds, the infrastructure is supportive for such growth. Also, the majority of the internet users are aged between 15-34 who also happen to be the largest spenders on entertainment. Everything thus seems to be in place for India’s promising growth in digital services. Saavn and Gaana were among the pioneers and continue to be major players of music streaming services in India. The promising metrics, however, have attracted major global players such as Apple Music, Google Play Music and Amazon music. Sportify too, although currently unavailable in India, aims to enter this market soon. This increasing competition has also led to amalgamations within the existing players. Google Play Music currently dominates the market share of music apps (since Android is the dominant OS amongst Indian smartphone users and Google Play Music comes as a pre-installed app in Android) while Jio-Saavn with their synergy are steadily encroaching Google Music’s market share.

The Problem

But is the Indian market really lucrative for music services when compared to the rest of the world? According to Statista, the user penetration in the music streaming segment is only 6.6% for 2018 expected to increase to 6.7% by 2022. India will be ranking 2nd in the number of smartphone users in 2018 which is expected to hit 530 million users by the end of 2018 representing 20.95% (2.53 billion users) of the global smartphone population. Given the increasing trend in smartphones and on demand media consumption, the growth figures for music streaming apps seem dismissive. To add further, the revenue from music streaming in India amounts to a mere 0.88% of the global revenue.

One major reason for this scanty revenue share is the pricing of these services. Apple Music, the most expensive amongst these services, is priced at Rs. 120 (~ $1.85) per month for an individual whereas majority of the other services are priced at Rs. 99 (~ $1.37) for the same plan. When compared to the average price of $10/ month for these services adopted globally, the pricing for the Indian market seems to be significantly reduced. One may argue that the prices have been adjusted based on the purchasing power of the Indian consumer, but that argument can be downplayed if we were to look at Netflix. Netflix in India has adopted the same pricing as its global counterparts (~ $12 for its median plan) and yet experiences a growth rate of over 40% every year, much higher than that of music streaming services. Why so then are consumers willing to shell out $12 video streaming but hesitant to spend less than $2 on music? The answer to that is piracy and the consumer mindset surrounding it.

Let me begin by answering the above example of Netflix vs music streaming. Netflix in India sits in the home entertainment category. When a person subscribes for Netflix, he is more than likely paying or is in a position to pay for monthly TV subscription the average price of which is about Rs 350 to Rs 500 (~ $5.4 to ~ $7.7) per month per television amongst popular DTH providers such as Tata Sky and Airtel. Thus, from an economic perspective, an average consumer’s decision when subscribing to Netflix is about deciding to spend the extra $5 - $7 when compared to a DTH service. On a side note, going to the cinema is also a common social phenomenon amongst families and friends. As a result, the Indian consumer is habituated for spending money on video content and entertainment. Music, however, is a contrastingly different commodity than video. Just like the rest of world, India too has transitioned from physical forms of music consumption such as vinyl, cassettes and CDs to digital forms such as mp3s on portable devices. During this transition however, the physical sales of legitimate CDs never got converted to legitimate downloads of mp3s. Hence both popular physical stores as well as digital stores have witnessed shut downs in the last five years. Music today is downloaded from illegal websites/ torrents and thereafter shared via Bluetooth and this has created a “music is available for free” mindset amongst consumers resulting in a consumer mindset that is reluctant to spend a dime on music. A consumer wouldn’t be as hesitant in spending additional $5 on a good/service as he would be in spending $2 on a good/service otherwise (although illegally) available for free thus explaining Netflix’s increased growth rate when compared to music services.

Piracy has been a major hurdle in the Indian entertainment market with varying degree of effects on various industries such as publishing, film, music etc. Both the reports mentioned above list piracy as a major obstacle for streaming services to achieve growth in India. The IFPI states that 54% of the internet users in India access unlicensed services on a monthly basis. Disguised with terms such as “jugaad” (which loosely translates to hack) and looked upon as a mere low-cost alternative lacking any association with theft of intellectual property, piracy is more of a mindset than a problem. In my own experience, I did not know what piracy is until the age of 12 and did not understand why it was wrong until much later. It was only when I started learning the guitar and following the Indian rock music scene that I became aware about the journey of a full-time artist and their struggles in order to survive in this day and age of piracy. During my trips to Rhythm house – a famous music store in Mumbai, I was often questioned by my peers and colleagues as to why I was still buying CDs and not just downloading music for free off the internet. After a while, I observed that this question was because of the lack of awareness about why piracy is wrong.

All the music streaming services in India, like the west, market themselves to consumers on the convince model by advertising access to millions of songs and offline listening for a monthly price. However, the Indian consumers’ mindset is different from the west. Kashyap Deorah, in his book - The Golden Tap: The Inside Story of Hyper-Funded Indian Startups states "Indian consumers love convenience as long as they don’t have to pay for it. They will live with the pain of the slight inconvenience of getting things from the alternate source, if it saves them money.” And I completely agree with Kashyap’s view. Although this statement is beginning to change amongst a small proportion of millennials and Gen Zs, it still holds true for the majority of the Indian population. The numbers of users in India on music streaming platforms in the above reports fail to provide a breakup between premium customers and free customers. However, given the low revenue per user, it is rational to assume that premium users are much lower than ad supported users. Piracy and “jugaad” have carved their way with apps such Saavn Pro that are easily available on black market apk websites. Saavn Pro is a cracked version of Saavn that offers users premium features for free by sideloading the app on an android phone. Popcorn Time is another popular application that lets users stream movies and tv shows over torrents. The point here is not to propagate piracy but to state that if convenience is the only offering being promoted by music streaming, the Indian consumer will stick to a little inconvenience or resort to black market apps because they are free. If Popcorn time or any other app starts to offer music streaming via torrents, those apps will prevail over legitimate streaming services.

How to work around this problem?

So, if piracy is so deep rooted, how can this problem ever be tackled? In this section I broadly categorise the possible solutions into two sections – fundamental and strategical. The fundamental approach aims to bring instil a new mindset whereas the strategic approach aims to implement new strategies for achieving growth.

Fundamental Approach

As I mentioned earlier, the problem with piracy is its lack of awareness amongst people about what piracy is and why is it wrong. Music companies too have not created much awareness about the same. The only mention of piracy I found was in this 10 second advertisement by Saavn which only conveys the message – Say no to piracy. While, I’m no marketer or copywriter, the advertisements that drive me to action are the ones that revolve around empathy. The joy of supporting a cause often outweighs the pinch of spending a few extra bucks. In my opinion thus, the advertising message should revolve around one such cause which is – streaming as a means to support the artists. With revenues from music sales being next to negligible musicians, especially independent and upcoming artists in the India find it hard to survive in an era of downloads and Bluetooth file sharing. Given the hard work, time and dedication that goes into learning a musical instrument and creating music, illegal and free distribution of music is equivalent of depriving hard-working labourer of his wages. And this should be the exact message being conveyed in the advertising campaigns. A campaign containing 4-5 different ads each showcasing the journey of a single musician/band should be initiated. The artists should be a mix of independent/ struggling artists and established artists each narrating their story/journey of their early days, the hours spent on training, coming up with their first song/album and their first breakthrough moment in a voice over. The video of the advertisement could focus on their interview, studio setup, photos from early days; all of this in an empathetic manner. The advertisement should then end by quoting – “Say no to piracy, switch to streaming, support the musicians.” The aim of this campaign is to put the consumers in the shoes of artists and make them aware of the pain points any artist goes through before achieving a breakthrough.

Strategic Approaches

While the above campaign would help in distinguishing the right from wrong, I know its approach is too utopian and not convincing enough on its own to draw large users from free downloads to paying Rs. 99 per month or having an ad supported listening experience. Thus, there need to be additional strategies which the company must adopt to drive growth.

Better Integration of Social Tools

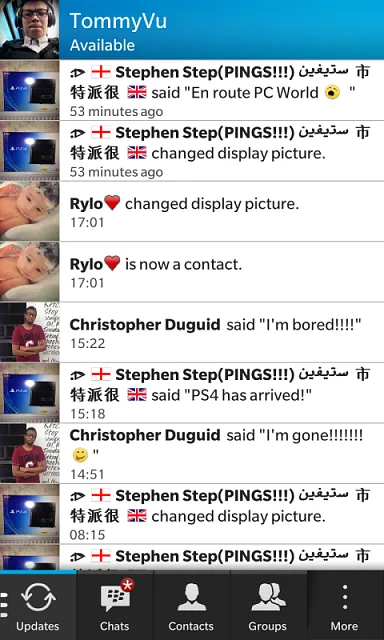

In order to elaborate on my first strategy, I would first like to throw some light on BBM - Blackberry’s Messaging service. From 2008 until 2012, BlackBerry were the amongst the pioneers in leading the smartphone growth in India. And the primary reason for this was BBM. Back then BBM was exclusive to BlackBerry hardware and required a special subscription from the telecom provider. The two subscription plans were priced at Rs. 99 and Rs. 399, the former let you access emails and BBM, while the latter also let you access the internet along with email and BBM (yes Rs. 300 extra for surfing the web on 2G). In spite of the constraints, as evident from the above article, Blackberry experienced a considerable growth in the Indian market because it targetted BBM to college students. Although regular SMS was cheaper and more reachable than BBM, being a member of BBM groups and updating BBM statuses was the definition of “cool” amongst college teens driving the sales of BlackBerry in India.

Music as product fundamentally differs from messaging, but the important takeaway from the above is that even a decade ago, teens and college students were willing to pay Rs 99 or above and buy special hardware only to be part of the “cool” movement. The subscription cost of music streaming apps is the same as that of BBM, but ironically, people who were BBM users a decade ago suddenly find it “too expensive” to pay for a streaming service. Music streaming companies need to move from the model of “convenience in your pocket” and shift to “uber cool” by targeting their product to teens typically Gen-Z’s and millennials. While using BBM, teens did not care about the security or the encryption of the app, what they really cared about was what their friends were up to in the Updates tab.

Screenshot showing Updates in BBM. Source: CrackBerry Forums

A similar pattern can be observed in music consumption too. Numerous studies and articles indicate the consequences of peer pressure on music consumption. In simpler terms, majority of the listeners are more interested in listening to music their friends are listening to than the chart toppers. It can thus be concluded that social dimensions play an important role in music consumption habits and such features need to be tightly coupled within the app. But currently, these apps do not offer many social features. Apple Music is the only service showing traces of integrated social features within a music app by showcasing what my friends are listening to in a small section along with recommendations based on my listening as shown in the image below. Forget social tools but even something as simple as sharing the song is not possible within the application and requires you to share the link using an external application. What music apps need to have are dedicated tabs like the “Updates” tab in the BBM which allow for direct viewing of friend’s listening activities. Additional features such as sharing songs within the app itself, ability to create groups for better sharing and listening, ability to create and update shared playlists etc. could also be incorporated. Such social features maybe useful in creating network effects and increase switching costs.

Screenshot showing Apple Music’s Social Integration

Screenshot of the share menu in Saavn

Screenshot of the share menu in Apple Music

Tweaking the Freemium Model

Another strategy that can be adopted is by tweaking the freemium model to reward the users. Majority of the music streaming apps offer a free trial period for users to try out the premium features. Some services such as Apple Music and Google Play Music restrict listening access without the purchase of a subscription after the expiry of the trial period. Other services such as Saavn and Gaana follow a more freemium approach by offering an ad-supported listening experience for free along with a premium tier offering. Both these apps use google banner ads in the app and audio ads in between songs. However, its easy to agree that google ads are intrusive cause much annoyance to the user. An interesting approach to such annoying ads was taken in late 2014 by a game titled Crossy Road. Instead of aggressively pushing for in-app purchases with pop-up ads and “save me” buttons, the developers of Crossy Road included video advertisements within the app. These video ads were completely voluntary to view and were not forced upon the users. Users who decided to view these ads were rewarded with in-game currency which could be used to purchase additional characters. Such an approach was received quite positively by the audiences and helped the game gross millions of dollars in revenue.

Music streaming apps too can adopt a similar strategy. Instead of showcasing annoying google ads which most of the audiences have grown immune to, these apps can develop their own advertising network and showcase video ads. Free users viewing such video ads could be rewarded with rewards such as in-app currency that can be used to buy premium subscription for a limited time or a limited quota of songs that can be downloaded for offline listening. For instance, viewing 5 ads of 2 mins each could let free users download 10 songs for offline listening. Any other reward strategy can also be adopted. The advantages of this strategy are two-fold. First, eliminating google ads would help improve the user experience as ads in this case would be viewed voluntarily. Secondly, google ads revenues are based on upon the clickthrough rate but most of the people today are immune to such ads and barely click on ad banners. The clicks which happen are also almost never intentional and mostly accidental in nature. However, with a direct advertising network, companies can earn much higher revenue per ad view. Also, since the ultimate user is rewarded for viewing of ads, the number of ad views are also likely to increase.

Conclusion

Piracy can be metaphorically compared to a leakage in the fuel tank wherein the fundamental approach aims to fix the leakage while the strategic approaches aim to refill the tank. Adopting just one approach is not going to lead the vehicle much further and a combination of such techniques need to be adopted if revenue is to be increased. While there is no manner in which I can vouch for the result of the solutions I have listed, I hope they offer a new perspective for building and implementing strategies.