Biometrics - A Boon for Farmers

The Government of India has started embracing biometric technology to implement various farmer welfare programs across the country.

Farmers are the backbone of our society. As a result, the entire population of the country depends upon farmers; be it the smallest or the largest country. The farmers' contribution is almost 17% to the Indian economy, which is the maximum of all. India is a country that incorporates 12 crore farmers, and according to the World Bank’s 2015 report, these 12 crore farmers nearly form 25 percent of the workforce out of the total 48 crore workforce of the country.

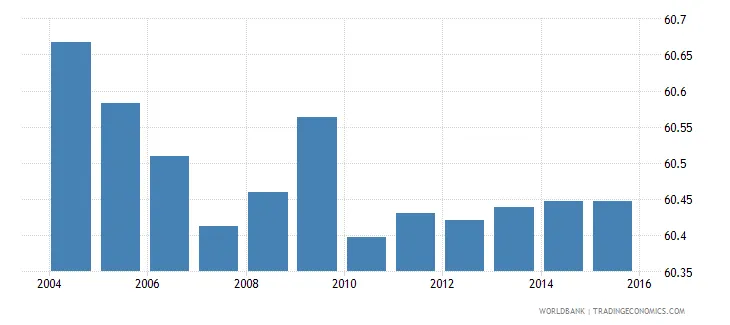

Agricultural land (% of land area) in India

Agriculture is an important part of India's economy and at present, it is amongst the top two farm producers in the world. According to the 2017-18 Survey, this sector provides approximately 52 percent of the total number of jobs available in India and contributes around 18.1 percent to the GDP.

Challenges faced by the Indian farmers

The Ministry of Agriculture & Farmers Welfare under PMFBY has categorized farmers into two major brackets, the loanee farmers and the non-loanee farmers. The loanee farmers are the ones who have availed the agricultural loans through various insurance companies while the non-loanee farmers are the ones who have not taken any loans.

As per the logistics, before floating PMFBY i.e. in 2015–16, only 28 lakh farmers have plumped on for the loans voluntarily. However, after the launch of PMFBY, the number of farmers opting for loans deliberately raised to 1.38 crore in the year 2016–17 compared to the year 2015–16. There has been an increase in the ratio of farmers opting for loans, but the small & marginal farmers are not able to get the benefit, be it technological lag or identity scams. Hence, a secure and scalable biometric technology seems to be desirable for the agro-based insurance industry facing the challenges related to sham insurance claims and transfer to the wrong accounts.

Farmers are also facing other challenges like:

- Inappropriate fund utilization and lack of transparency in the fund management system.

- Middleman's intervention leads to siphoning off funds.

- Traders & middlemen purchase grains from farmers and then resold them to the government program, pocketing the price difference.

- Crop insurance scams based on fake identity proofs.

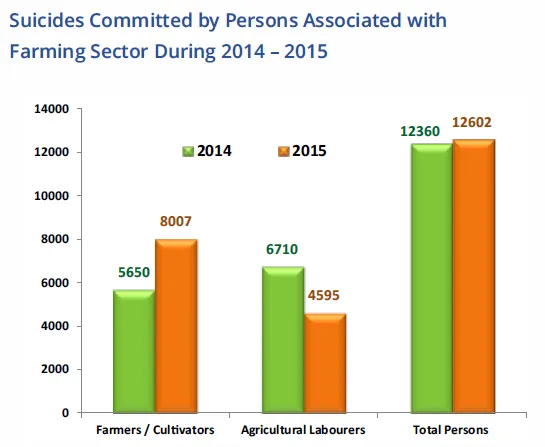

- On average over 12.5K farmers’ suicides have been recorded from 2011 to 2016 as per National Crime Records Bureau records; out of which 38.7% are due to bankruptcy/indebtedness.

Classification of Farmers (Year-2017)

All these issues call for a reliable, efficient, and sophisticated mechanism of identifying farmers, bringing transparency and better enforcement of the programs. Thus, the farmer’s dependency on receiving their benefits depends hugely on the government rather than the middlemen.

Technological Advancement in Agro Industry for Farmers

Biometric Technology

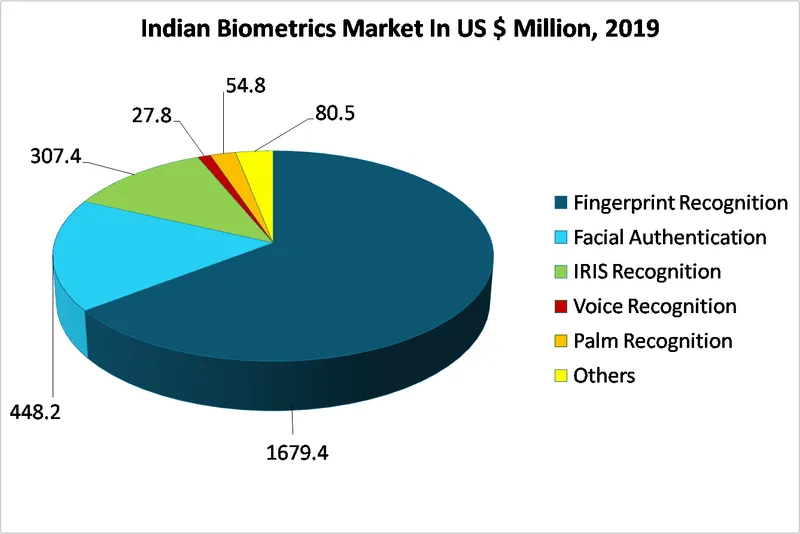

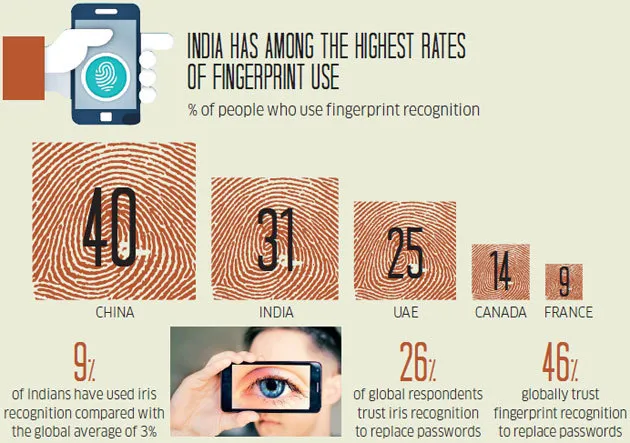

With over 260 million Indians engaged in agriculture, it was pivotal for India to enable easier, more secure access to services. Thus, with the proliferation of groundbreaking biometric fingerprint & IRIS systems, the Govt. started disbursing welfare benefits to farmers using Aadhaar-based biometric authentication to ensure that the benefits go directly to the eligible & needy/smallholder farmers.

Indian biometric market share in US million

For the farmers in remote areas of India, there has been a banking revolution with the emergence of biometric-based micro ATMs. Few of the benefits the system renders are:

· Easy opportunity to approach financial assistance

· Doorstep payment

· Minimized queuing

· Swift transactions

· Improved security

Since its inception, biometric technology in banking has been tremendously beneficial to farmers facing the barrier of illiteracy and helped them with financial security and equality.

Integrated and Embedded Technology

More than 65% of the population remains aloof to the banking facilities. To bring them under the banking net, the RBI introduced a regulation in 2006 allowing banks to provide service at people’s doorstep through the use of integrated & embedded technology-based modern-day tools like Biometric MicroATMs and Apps.

There are about over 2 Lakh ATMs in India, according to RBI data. Of these, 1,03,282 are onsite and 98,579 offsite, the number is still small when compared to the actual demand. Biometric-based micro ATMs are handheld Point-of-Sale (POS) terminals used to disburse cash in remote locations where bank branches cannot reach using the latest fingerprint scanner attached to it.

Banks have deployed as many as 1.95 lakh business correspondents (BCs), covering 2.21 lakh villages across the country as of March 31, 2013. Also, According to the RBI, 12.84 Cr Kisan Credit Cards had been issued up to 2012-13.

Recommendations to mitigate the challenges

In the wake of the current scenario, to support the farmers with agricultural subsidies or direct transfer benefits and attain sustainable development goals, advance technology like biometric spurs the system of equitable benefits in the agricultural sector. The biometric characteristics (fingerprint and IRIS images) of farmers help the Govt. in identifying eligible beneficiaries, ensuring only the right person receives the benefits of various farmers’ welfare programs.

If we look through the lens of small and marginal farmers, they are not getting the benefit of insurance claims besides they did not even receive their right to obtain benefits under direct benefit transfer (DBT) program. Many times, the amount paid goes to the account of the wrong person. It is, therefore, the cutting-edge biometrics technology that provides a robust and reliable solution for these entire crannies in the farm insurance sector.

To scrape off the ghost beneficiaries, in April 2013 the government decided to extend the direct benefits transfer (DBT) and asked the farmers to link the Aadhaar with their respective bank accounts. Thus, Aadhaar-based biometric systems ensure that the identities of the beneficiaries is verified precisely, adding an extra layer of security.

Several government-led farmers’ welfare programs and initiatives are implementing Aadhaar-based biometric authentication, offering several benefits to farmers like:

· Ensures accountability, transparency, and reliability.

· Saves the time of farmers.

· Faster settlement of insurance.

· Track and monitor fund utilization.

· Prevents fraudsters from claiming fake insurance/loans.

· Eliminates middlemen from the system.

· Facilitates the transfer of payments directly to identified farmer’s bank accounts.

· Curtail fraud and ensures security when distributing the subsidy.

· The real-time biometric method prevents duplicate registration attempts.

· It allows only eligible farmers to purchase fertilizer at subsidized rates under the DBT program.

Initiatives taken by the Government for welfare of farmers

Pradhan Mantri Fasal Bima Yojana (PMFBY)

The Pradhan Mantri Fasal Bima Yojana(PMFBY) launched in 2016 is an insurance service for farmers for their yields. PMFBY provides a comprehensive insurance cover against the failure of the crop thus helping in stabilizing the income of the farmers. However, the crop insurance schemes were in the need of the hour of state-of-the-art biometric technology to accurately identify farmers and ensure benefits are going to the right person.

As per the Guru Arjan Dev Institute of Development Studies 2016 reports, so far, 3 Lakh biometric devices have been utilized PAN India by individual agents to enroll and identify farmers for fair, faster, and timely settlement of insurance claims.

National Agriculture Insurance Scheme (NAIS)

The National Agricultural Insurance Scheme (NAIS) was introduced to protect the farmers against crop losses suffered on account of natural calamities. It envisages coverage of all food crops to the loanee and non-loanee farmers by identifying them using biometric scanner devices.

The Aadhaar-based biometric farmer’s authentication assists the government in transferring the benefit amount directly to the eligible farmer’s Aadhaar-linked bank account, aiding farmers to receive their claims on time.

Subsidized Fertilizer

Fertilizer subsidy is the second-largest subsidy, after food, provided by the GOI with a budget of INR 70,000 Cr in FY 17-18. The government in 2016, announced pilots for Aadhaar enabled Fertilizer Distribution System (AeFDS) across India.

AeFDS is a modified subsidy payment system under the DBT scheme, where retailers sell fertilizer to farmers/buyers only after successful Aadhaar authentication via Biometric-based Point of Sale (PoS) machines. Biometric authentication is helping policymakers get a better picture of the farming activity in the country.

Pradhan Mantri Samman Nidhi Yojana (or PM-Kishan Yojana)

PM Kishan Yojana is India’s first national-level direct benefit transfer for farmers. The program provides eligible farmers (those with less than two hectares of land) with 6,000 rupees every year. To receive benefits under this scheme, farmers need to enroll themselves in an online program using Aadhaar and biometrics. Biometric scanners help the government disburse the benefits of the scheme directly into the Aadhaar-linked bank accounts of eligible farmers under the DBT program.

In 2019, Bihar Government has implemented Mantra IRIS Scanner – MIS100V2 and Fingerprint Scanner – MFS100 for the registration of farmers under the Direct Transfer Benefit Scheme (DBT) to provide them with the benefits of subsidies, grants, and compensation under PM-Kishan Yojana.