Shadowfax pilots dark stores to help D2C players reach customers faster

Through Shadowfax's dark-store model, D2C brands and sellers can reach consumers in 2 to 4 hours, especially in densely populated areas, offering instant gratification.

The unit economics of delivering a shampoo in 15 minutes may not work out for D2C (direct to commerce) brands and vertical marketplaces, but they are still keen to improve delivery speed to match customer expectations in the age of quick commerce and instant gratification.

Third-party logistics player Shadowfax is proposing a strategy for the same: a network of dark stores to help D2C brands and sellers of lifestyle products reach their customers faster and in an “economical” way.

Using these dark stores, sellers may not be able to fulfil online orders within minutes, but they can reach customers in 2 to 4 hours, especially in densely populated areas.

A vertical marketplace in the beauty and personal care (BPC) segment, a supplements provider, and an apparel brand are among the companies that have tied up with Shadowfax for the dark-store model.

Shadowfax—which began piloting this model around four months ago—currently operates 10 such stores in Mumbai, Delhi and Bengaluru.

It offers two options: brands can operate their own dark stores and use the logistics company for last-mile delivery or they can let Shadowfax manage their inventory and deliver within 2 to 4 hours from the time the order is placed.

In the case of exclusive dark stores, Shadowfax provides only last-mile delivery, while maintenance, warehousing, and other operations are under the brand’s purview.

Under the second option, Shadowfax owns, runs and operates the dark stores—which are shared by multiple brands—and also provides last-mile delivery. This enables brands to dabble with rapid commerce without incurring any significant investment that comes with running their own warehouses.

Shadowfax operates 6 multi-brand dark stores in the country.

Rationale behind dark stores

How will the dark-store strategy benefit vertical marketplaces and D2C brands which are fighting on multiple fronts with quick commerce platforms?

“On quick commerce platforms, commissions can range from 25% to even 40% of the product cost, particularly for D2C brands for whom commissions often start at 35%, with additional one-time fees. When cost of marketing and ads are factored in, overall expenses can exceed 45%,” says Praharsh Chandra,Co-founder & Chief Business Officer.

Though dark stores come with warehousing and logistics fees, Chandra believes the model can help brands cut overall costs as it scales up on volume and density beyond the pilot stage.

“The costs under the dark-store rapid commerce format is expected to be 20-30% higher than the current hub-and-spoke model of parcel delivery,” he says.

However, he believes the model has the potential to be profitable with higher throughput i.e. more orders per dark store. As the model scales, it will also enable optimisation in last-mile delivery and warehousing, he adds.

Shadowfax is not the only logistics player dabbling in dark stores for rapid commerce; its listed peer Delhivery is also considering dipping into it. The CEO of Delhivery, during the company’s townhall, said Delhivery would launch a network of dark stores for some clients and assess how they scale up.

Arvind Singhal, Chairman at Technopak Advisors, which provides consulting services in the consumer products and retail sectors, says as the market grows more competitive, it will witness a fight for market share, more than profitability.

“The surcharge and various other charges will all disappear when the market gets more competitive. It will be a fight to just get the share of the market as opposed to profitability, and the companies which will come under maximum pressure are the likes of Zepto, Blinkit and Instamart,” says Singhal.

Quick commerce Vs rapid commerce

New-age brands and vertical marketplaces in the BPC space are realising that delivering low-value products with limited order volumes in under an hour, over distances greater than three to four kilometers in urban areas, is not economically viable.

“The unit economics of trying to deliver a kajal in 20 minutes by itself to a consumer in Bombay are never going to be very good,” said Sahil Barua,Co-founder & CEO of logistics service provider Delhivery, during the company’s FY25 first-quarter earnings call.

However, D2C players and marketplaces aren’t completely shunning quick commerce and are instead choosing to deliver ‘rapidly’—on the same day or the next day.

A report by TechCrunch says that online lifestyle platform Myntra is looking to introduce 2-4 hour delivery in select Indian cities.

Beauty products marketplace Nykaa has rolled out same-day and next-day delivery in over 110 cities; close to 60% of all order volume from these cities is being delivered within the next day, noted Falguni Nayar, Chairperson, MD & CEO of Nykaa, at the company’s AGM.

According to industry sources, Nykaa is piloting exclusive dark stores in densely populated localities as it tries to gain an edge over competitors such as Reliance-backed Tira and Purplle.

Delhivery executives, during the company’s townhall, also hinted at the company's plans to work with Nykaa on the dark store front.

“We continue to listen to our customers’ needs of speed versus deeper selection and experiment with different delivery models, underscoring our commitment to driving improved access and delight for millions across the length and breadth of the country, servicing metros, large cities and Tier II and III towns of India,” says a spokesperson from Nykaa.

Challenges of scaling up

Dark-store based rapid commerce comes with the challenges of working capital and figuring out the inventory to hold. Brands also need to work out how many dark stores they need to put in place to service multiple locations and pin codes.

Chandra says, “A structural issue of such a mode is whether you’re keeping the right inventory at the right location at all points in time. This is because a lot of 10-minute, 60-minute or 120-minute commerce is to do with predicting what a customer wants to purchase and having that nearby.

“We don’t yet have a definitive view on the potential scale of rapid commerce, but we know that the number of SKUs available in this format will be much lower, as micro facilities within cities can only store a limited range and are typically concentrated in metro areas.”

Experts in the ecosystem are sceptical of the immediate impact and success of the model, especially from a consumer’s point of view.

Singhal of Technopak says, “If you reach a certain scale, in some cases, you might get better margins, which you can pass on to the customer.”

It’s still early days for the dark-store strategy, and it may not cause a big impact on Shadowfax’s total business in the near term.

However, the logistics player is betting big on same-day and next-day delivery models, using the existing warehouses of brands and marketplaces. These categories together account for almost 10-15% of Shadowfax’s total business. The number was less than 5% last year.

“We expect rapid commerce to represent a smaller share of total online commerce. Instead, a significant portion of orders and SKUs will likely shift to same-day delivery formats, which we have already demonstrated to be scalable and cost-effective,” says Chandra.

Infographic: Mayank Dahiya

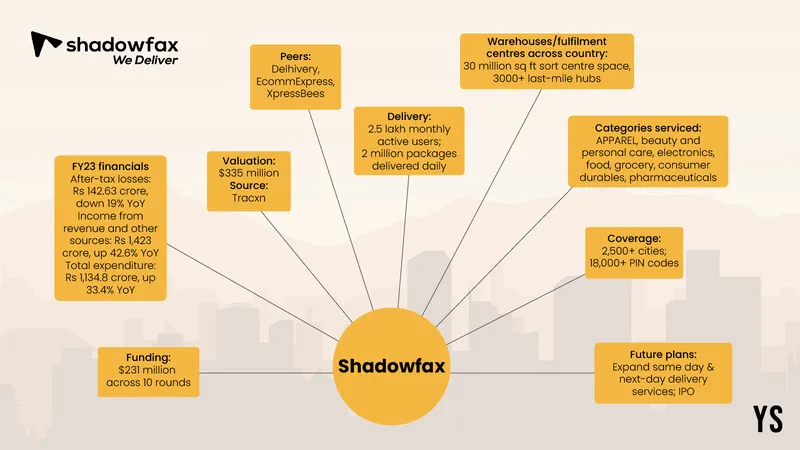

For FY23, Shadowfax pared down losses after taxes by 19% to Rs 142.63 crore from the year-ago period. Its income from revenue and other sources rose 42.6% to Rs 1,423 crore, up from Rs 997.3 crore in the previous year.

Shadowfax has secured a total funding of $231 million from 10 rounds, according to market intelligence platform Tracxn.

In February this year, it raised $100 million in a Series E round led by TPG NewQuest. The round also saw participation from existing investors Mirae Asset Venture Investments (India), Flipkart, International Finance Corporation, Nokia Growth Partners, Qualcomm, and Trifecta Capital.

The funds were raised for offering specialised services to D2C brands, expanding to new pin codes, and enhancing Shadowfax’s express delivery network.

(The copy was updated with an infographic.)

Edited by Swetha Kannan