Multiple pivots, bad customer service cast a pall on Zoomcar’s India bet

Over the past decade, Zoomcar has failed to make the big waves many thought it would in India, even as it prepares for a listing on NASDAQ.

arrived in 2013 with a promise to revolutionise mobility. Uber was a few months away from launch, while Ola was blitzscaling, but both were focussed on providing a taxi-like service on demand. Zoomcar’s proposition was unique—renting a car for a fraction of the cost of owning it.

Self-drive car rental wasn’t a new concept—it was quite popular in Europe and the United States; Hertz, Avis, and Alamo, among others, had been around for decades.

But in India, before the arrival of Zoomcar, the self-drive rental market was fragmented. With its tech stack, the car-sharing company acted as a “great uniter” and platformised the market.

Zoomcar, however, hasn’t been able to create the success or impact in India that Hertz and Avis have in the West. Blame it on several pivots and experiments with different business models, customer dissatisfaction, and deficient product-market compatibility.

Led by Co-founder and CEO Greg Moran, the company is now preparing for a listing on NASDAQ, taking the SPAC (special purpose acquisition company) route. Zoomcar said last year it would merge with blank check firm Innovative International Acquisition in a deal worth $456 million.

(A blank check company doesn’t have a defined business plan and primarily engages in mergers and acquisitions.)

The Bengaluru-headquartered Zoomcar rationalised that a US listing would be more lucrative because the market there is more stable, extensive, and dynamic than its Indian counterpart, Moran explains to YourStory.

“Crosslisting at some point in the future isn’t ruled out,” he says, adding the company will list in the next two-three quarters. A US listing could also aid its ambitions to expand overseas.

But most importantly, Moran says this will enable Zoomcar to achieve exponential growth in the upcoming quarters, and, notably, fortify its latest pivot to a marketplace platform that allows owners to list their cars for potential renters to lease.

Zoomcar has raised $264 million in funding so far from investors including Sequoia Capital, Mahindra & Mahindra, and SternAegis. It recently announced over 20,000 car listings across India, Southeast Asia, and Egypt.

Diversions plague growth

Zoomcar's decade-long journey in India has been tumultuous, marked by a series of pivots and strategic moves that have not been very successful in yielding the desired results.

One of Moran’s early backers, who did not want to be identified, says Zoomcar was ahead of its time when it launched in India.

The company first bought a small fleet of cars and started leasing them out via its platform. A few years down the line, Zoomcar realised it couldn’t pull off an asset-leveraged model since that was capital-intensive.

Consequently, it launched Zoomvest and tried convincing wealthy individuals to invest in purchasing a small fleet of cars that Zoomcar would lease out to earn them, and itself, a neat profit. But the model failed to generate the margins it had promised.

The company then thought it had chanced upon a winning idea with ZAP Purchase, encouraging people who had just bought their first car to list it on the platform for renting, and use the income generated to meet EMI payments.

Of course, it did not work because no one wanted to lease out their brand-new car. The handful who did encountered an array of unaddressed issues including cars being returned in a damaged state and with original parts substituted with low-quality ones.

In 2017, the company launched PEDL, a dockless cycle-sharing subscription service, which it shut a year later to upgrade the cycles saying “demand for the services is extremely high.” The service never surfaced again, even though the company had said it would.

Before settling on its latest pivot, Zoomcar also experimented with rental self-drive scooters and bikes, and another model called the ZAP Subscribe. During COVID-19, it launched a software-as-a-service (SaaS) platform for fleet management, as well as a platform to help third-party car rental companies manage their businesses.

In 2019, the company took a leaf out of ZAP Subscribe and launched a marketplace model—similar to Airbnb—that allows car owners to rent out their vehicles to interested borrowers based on ratings and feedback from other owners.

Moran tells YourStory that the marketplace has enabled Zoomcar to build supply density, and will help it blitzscale not just in India but also in other countries where it has a presence or wants to expand to—Egypt, Indonesia, Vietnam, etc.

“Our vision was always to become a marketplace, but regulations had made it hard initially to do it,” Moran adds.

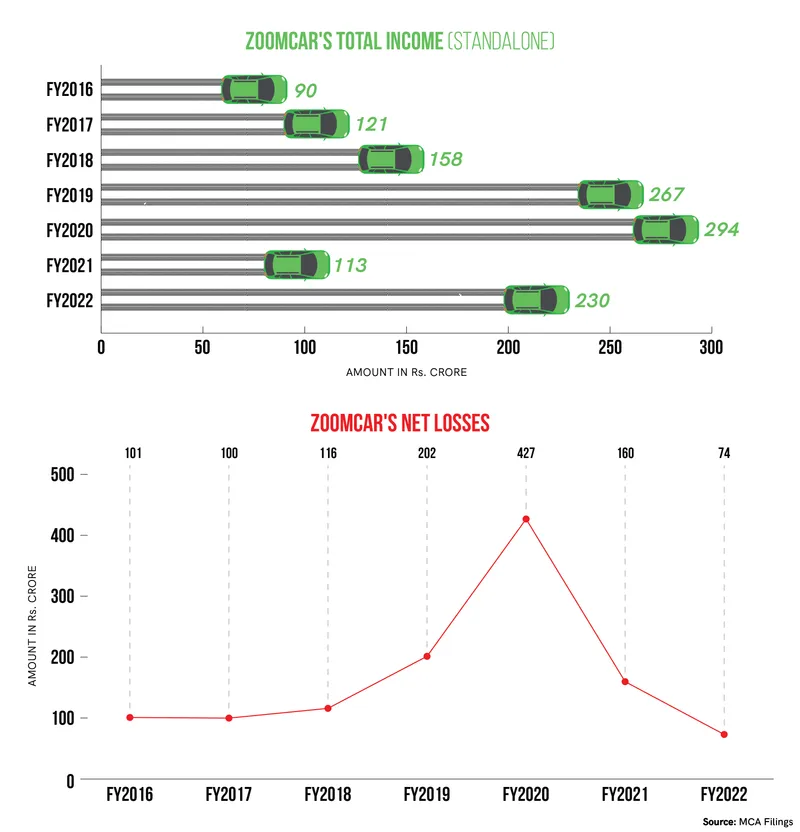

Zoomcar says it has around 3 million active users on the platform. However, it hasn’t turned a net profit to date, and reported a loss of Rs 73.56 crore in financial year 2021-2022 on revenue of Rs 230.23 crore. Its biggest loss was in FY 2020-2021—Rs 427.41 crore—mainly due to COVID-19.

Customer dissatisfaction has been a huge impediment to Zoomcar’s growth, largely due to opprobrium to the company’s lack of focus on customer care through reviews on websites and YouTube.

Two months and counting

Last year, Mr S, a Bengaluru resident and owner of a car, decided to lease out his vehicle on the Zoomcar platform to earn a few extra bucks. The first booking went smoothly, but during the second one, his car met with an accident.

Zoomcar got the issue sorted out on its end, Mr S tells YourStory, and he was satisfied with the resolution. Three months later, another accident happened. He was informed through the app that the car had been towed away to the company’s vendor garage for repairs in Mysore.

Thereafter, it took Mr S multiple calls and emails, and 15 visits to the company’s Indiranagar, Bengaluru office to get his car back. Zoomcar, he says, was always very obscure about his vehicle’s whereabouts, when it would be returned, or even what the issue was.

During one of his visits to its office, he says he encountered a Mahindra Xylo owner who disclosed that his car was returned with several original parts replaced by inferior quality alternatives, including tires, headlights, and seats.

Mr S then decided to get in touch with the garage where his car was apparently being serviced, only to discover that its proprietor refused to relinquish the vehicle unless Zoomcar paid off Rs 9 lakh the company allegedly owed it. When he got his car back, it was in a deplorable condition, with a deflated rear tire and a broken headlamp. Zoomcar assured Mr S that it would reimburse the repair costs—but that hasn’t happened to date.

As per the company’s T&C, Mr S was also entitled to a compensation of Rs 16,000 for the two months of downtime when his car was in the garage, but he says the company has removed any record of the accident.

There are plenty of reviews on different websites of cars being stolen, being returned to owners with multiple dents, scratches, and garbage, and carrying multiple, unpaid traffic tickets. Several “hosts” and customers YourStory spoke to said they won’t return to the platform.

“… Zoomcar’s management or customer support doesn’t really care… they don’t have customer support to begin with; I tried calling them at least 30 times on the number they listed on their website,” a renter who’d leased out his Hyundai i10 left a review on the platform.

Brushing with the law

When asked how Zoomcar is able to facilitate the use of personal vehicles for commercial purposes, especially given the regulatory crackdown on companies like Ola, Uber and Rapido, Moran says the company is in the clear because it ensures that all cars being leased out on the platform have yellow boards.

However, one of the hosts on the platform told YourStory, under condition of anonymity, said that Zoomcar does not independently verify the licence plates. The Indian law does not permit personal cars (carrying white number plates) to be used for commercial purposes.

Users have reported otherwise.

“I’ve personally driven a whiteboard Zoomcar in two different cities,” says Radhika Singh, a resident of Delhi. “I’ve never had a problem… the owner, in fact, told me that Zoomcar did not do anything about the whiteboard issue when he flagged it to them.”

Recent customer reviews on Zoomcar asking people to stay away have cast serious aspersions on the company’s reputation. A potential investor the company had been speaking with to raise funds says Indians are “no longer the kind of people who will avail a service just because it’s available.”

“The Indian consumer is demanding more and deserves more,” he adds. “Zoomcar has missed a huge opportunity by ignoring customer service.”

(Infographics, illustrations and cover image by Nihar Apte)

(Updated to clarify that Uber launched in India months after Zoomcar in the first paragraph.)

Edited by Kanishk Singh

![[The Turning Point] How pivoting from a SaaS to marketplace model worked for B2B unicorn Zetwerk](https://images.yourstory.com/cs/2/70651a302d6d11e9aa979329348d4c3e/Zetwerk-1630653519416.png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)