[YS Exclusive] After Zerodha, Upstox flags growth concerns amid market volatility

Monthly new user additions and active clients for the Tiger Global-backed discount broker have plunged, allowing rivals to gain market share. Upstox is fighting back with a slew of ambitious new products, including an entry into US stocks.

At the beginning of last year, was snipping at the heels of Zerodha to be the market-leading online discount broker. It had just raised capital from Tiger Global at an estimated worth of $3 billion-$3.5 billion, making it notionally more valuable than the bootstrapped Zerodha and upstart Groww. It had more registered users too.

Over the last couple of months, though, Upstox has been battling slowing growth, which it attributes to fewer demat account openings and a volatile stock market. The company, which is also backed by Ratan Tata, has slipped in terms of both market share and active users, forcing it to temper its long-term growth projections. (Demat, or dematerialised accounts, hold financial securities digitally.)

In May last year, shortly after it crossed 10 million users, Upstox told YourStory it was targeting an additional 20 million-30 million users in the 2022-2023 financial year, and expecting to scale up to 100 million users over the next 4-5 years.

Upstox maintains that it currently has 10 million-plus users, declining to disclose exact numbers. As for its 100 million-user account milestone, the company expects it to be stretched by a couple of years.

“We are still gunning for our larger goal of having 100 million accounts with us… (but) it will take us a little bit longer because of the economic climate,” Co-founder Shrini Viswanath told YourStory, declining to share the company’s revised milestone targets.

Overall, the number of demat accounts in India increased 31% year-on-year to 110 million in January. Incremental additions of demat accounts at 2.2 million in January were higher than in the preceding four months, but still below the average run rate of 2.9 million in the financial year 2021-22, per Motilal Oswal Financial Services.

Upstox, which has more than 80% of its customers from tier II and tier III cities, earns money from minimum commissions on stock market investing and trading.

Viswanath expects that Upstox, which last raised $108 million in its Series C round in November 2021, will be profitable at the net level in less than two years.

A volatile market

in May 2021 doubled its self-estimated valuation to about $2 billion for a buyback of shares from employees. It was a bull phase for the stock markets, and Zerodha termed its valuation “conservative”.

In December last year, though, Zerodha raised a red flag. India’s largest stock broking platform in a business update warned that its revenue and profitability would be affected from the financial year 2023-24 owing to a 50% decline in new monthly account openings and weakening market momentum.

CEO Nithin Kamath said the decline in account openings was similar across the industry.

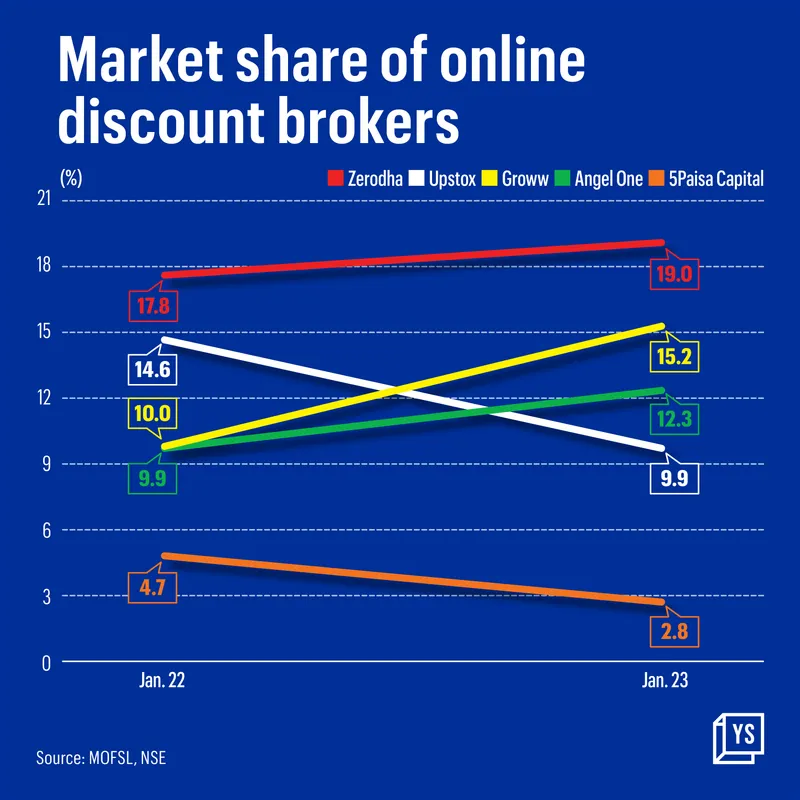

Zerodha retains the top position among online discount broking platforms, improving to 19% market share in January this year from 17.8% a year earlier, per data from Motilal Oswal Financial Services. Upstox, meanwhile, has fallen from the second position to fourth—its market share declining from 14.6% to 9.9%.

Upstox also went from adding 300,000-400,000 new users every month in 2020-2021 during the pandemic to about 200,000 new accounts monthly in the recent past.

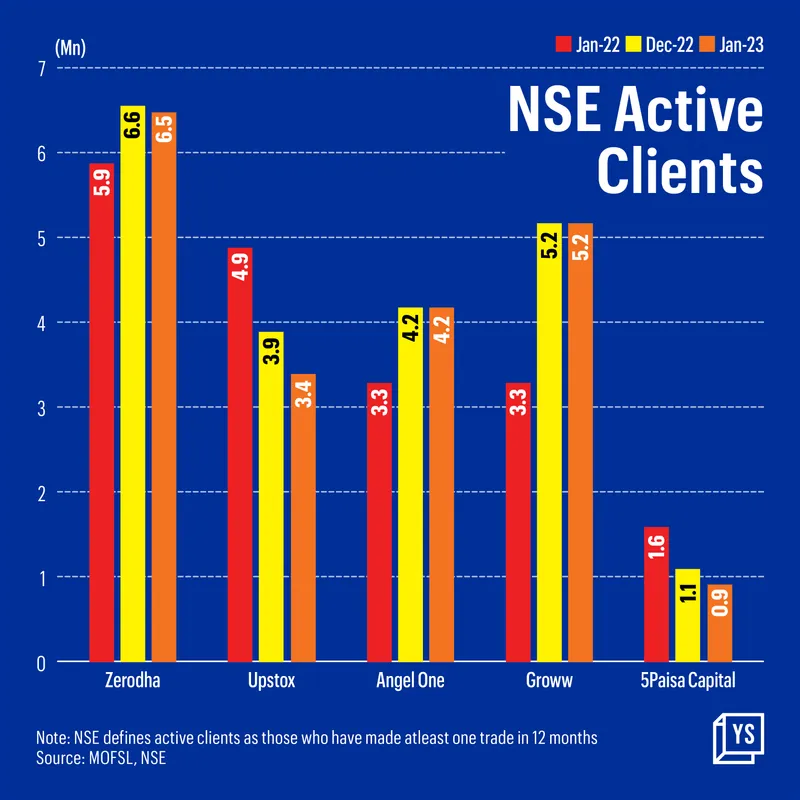

Active clients on Upstox dropped to 3.4 million in January this year from about 4.9 million a year earlier. The National Stock Exchange defines an active investor as someone who has made at least one trade in the previous 12 months.

Groww, founded seven years after Upstox in 2016 and valued at about $3 billion, meanwhile marched ahead, vaulting to 15.2% market share in January this year from about 10% a year earlier. Client count increased to 5.2 million from 3.3 million over that period.

“Groww is trying to attract new investors or users with lower account opening costs as compared to Upstox and Zerodha,” said an industry analyst on condition of anonymity. “If Groww continues to roll out new products and services at a faster rate, it will be able to further increase its new account openings.”

Zerodha, Groww, AngelOne, Upstox, and 5Paisa account for 59.2% of all active investors recognised by NSE.

New focus areas

Upstox has no plans to offer steeper discounts or reduce its commission structure further.

“Everyone has moved to a discount brokerage model. Users may not necessarily care whether they’re paying Rs 20 a trade or Rs 10 a trade,” said Viswanath. “That’s not the reason why there’s been a drop in terms of the number of new demat accounts. It’s honestly because people are uncertain, they’re not sure how to invest in the market, why to invest in the market, or why it has been so volatile.”

He added that the company’s focus for 2023 would be to step up its learning and educational divisions.

For Upstox to regain its market, analysts say it needs to increase the pace of new product launches.

“We are looking at getting into US stocks and fixed deposits in the next three to six months,” said Viswanath.

Other launches include an education platform called upLearn, and strategy builder tools for options trading, margin pledging and margin trade funding.

Although a big part of Upstox’s revenue comes from brokerage fees and commissions, it is seeing an increase in interest in the futures and options segment.

“We want to focus on building better tools, specifically for futures and options traders,” Viswanath said, offering some advice to traders: “If you are going to go for options, then don’t go for just a naked put or naked call, but rather try to follow a strategy that outlines what you’re doing. So you can minimise your risk.”

F&O “is another big focus for us for this year,” Viswanath said, “because we’re seeing options turnover just explode.”

(Feature image and infographics by Chetan Singh.)

Disclaimer: This story has been updated to change the featured image.

Edited by Feroze Jamal

![[YS Exclusive] After Zerodha, Upstox flags growth concerns amid market volatility](https://images.yourstory.com/cs/2/44be48705a1b11eb9642cd5f5fdd563d/Upstox2copy-1677135436906.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)