Freecharge

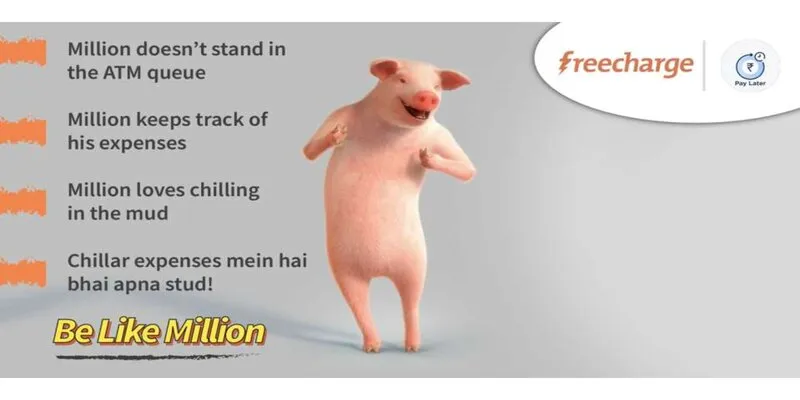

View Brand PublisherWith its new offering ‘Pay Later’, Freecharge is focused on being the go-to line of credit for millennials

In a country like India, finance is quite fragmented, not easily accessible and clogged with paperwork and processes. Personal loans or credit cards are usually the go-to lines of credit for most people, but it comes with a host of hidden charges and high interest rates.

In the last few years, a more flexible solution has emerged in the startup space - "Buy Now, Pay Later (BNPL)". BNPLs are credit lines that power offline and online purchases, without having to worry about your bank balance at that moment.

BPNL has been well received in India as it is the most convenient over any other payment method, which usually requires a one-time password (OTP) or a pin. The former is a pre-approved amount sitting in your app, ready to be used with a single tap. Be it for making mundane bill payments or for daily small payments or ‘chillar kharchas’ in Indian parlance, this is much faster and easier. According to Bernstein, from a $15 billion gross merchandise value (GMV) opportunity today, pay-later will boom to a $100 billion GMV opportunity by 2025.

India's leading digital payments player, has recently entered the BNPL space with its new offering 'Pay Later', where users get a monthly credit limit of up to Rs 10,000 to make purchases or payments.

Changing the way credit works

Over the years, Freecharge has been better known for its seamless utility bill payments services like gas, mobile recharges, electricity, broadband and DTH. Today, it's continuously innovating towards being a one-stop financial services app for its customers. The company has a wide range of products across investment, payments, lending, fixed deposit, digital gold and credit card.

On the lending front, Freecharge offers instant pre-qualified personal loans, all of which are supported by its holding company, Axis Bank. Customers can avail big-ticket loans of up to Rs 25 lakh and small-ticket loans up to Rs 60,000 at competitive pricing. These loans are hassle-free and instant as they get directly credited into your bank account, and can be paid back in easy EMIs.

The 'Pay Later' offering, also backed by Axis Bank, comes as a relief for millennials who are hesitant to jump on the credit bandwagon with loans or credit cards. It primarily targets 22-30-year-olds, who are salaried or self-employed and in the long run, also helps improve their credit score.

“We have launched this product to increase engagement of our users by providing them with a seamless payment product backed by a credit limit. The facility enables our customers to pay for their small-ticket purchases both online and offline with mobile being the form factor, rather than cash or cards,” says Siddharth Mehta, CEO, Freecharge.

How does Freecharge Pay Later work?

The option is available to users of Freecharge, where they receive a monthly credit limit of up to Rs 10,000. This can be used for shopping at 25,000+ offline and online merchants and making any bill payments and recharges, be it mobile, DTC, electricity, water, gift cards etc, barring the purchase of gold, deals and mutual funds.

It's a secure one-click process where you don't have to memorise card numbers, load your wallet or wait for OTP approvals.

Once a month, a single bill is generated, which includes all the expenses incurred during the credit period. You will need to make the payment on the day the bill is generated, and this can be done using a UPI or debit card.

The option to set up an eNACH mandate is also in the works. eNACH mandates will allow customers to digitally approve multiple recurring payment charges, so that the amount can be automatically deducted from their bank account.

Also, for any payment being made using Freecharge Pay Later, the transaction amount cannot exceed Rs 2,000.

“As we’re just getting started, we have set a small usage limit till the customers get accustomed to the overall process. We believe this will enable a learning curve not just for the customers but also for us in providing more customised solutions. As things progress, we are open to looking at customer-specific options," says Siddharth.

On eligibility, refunds and non-usage

While Freecharge has opened up the 'Pay Later' offering to all its customers, there are a few instances where your application could get rejected. First, because you haven't accepted the final terms and activated Freecharge Pay Later within 30 days from when the offer was generated. Second, it could be because you're not eligible to avail this offering as per the terms, conditions and internal policies of Axis Bank. And finally, if your KYC verification fails, you will not be able to get 'Pay Later'.

In case of refunds from merchants for payments, it will be adjusted in the due amount during that billing cycle. If the refund is processed after the end of the billing cycle, the amount gets credited to the Freecharge wallet.

How do you start using Pay Later?

To start using Pay Later, all you need is the Freecharge app. To start your application process, click on the ‘Pay Later’ icon on the app.

If you're eligible, the account gets approved. The approval is valid for 30 days, and you need to activate your account within that period. If you fail to do so, you will have to apply for a new Pay Later account from scratch.

Know more about Freecharge Pay Later