An investor's take: are startups a good investment?

While the wealth creation opportunity that startup investments provide is nearly unparalleled, it is also extremely risky, and conditional.

Investing in startups is more of an art and less of science - it isn’t meant for everyone,and is subjective. There is neither a method to this madness, nor a defined college degree to help you learn venture investing. Every deal, experience, and strategy shared in public domain is anecdotal.

I love startups as an asset class for investment because besides capital, I can offer my time. Unlike other investments such as public equities or real estate, I can’t influence an outcome. Venture investing is a people business.So,if you like meeting, working, and helping people, then your chance of success is very high.

With early-stage startups as a lead investor, I work closely with founders to create a positive outcome. So before beginning a discourse on the merits and demerits of investing in startups, let’s first understand investing in startups from the bottom up.

What is investing?

It is the process of putting money into various physical or abstracted assets with the expectation of making a profit. One can expect to make a profit on the money invested by seeing an increase in the value of the asset - whether real or perceived - and selling off the asset at the increased value. When you invest in a company - public or private - you invest in the asset, i.e.,the company itself, and you get a part of the ownership of the company.

As the value of the company increases, so does the profit you can make by selling off your stake. A key difference between investing in public companies and private ones like startups is that in public companies, selling off your stake is much easier and near instantaneous. The same cannot be said about private investments - hence it is one of the most illiquid asset classes. It can give you huge profits, but those profits will be only on paper for the most part as realising an exit takes a lot of time.It is an illiquid investment.

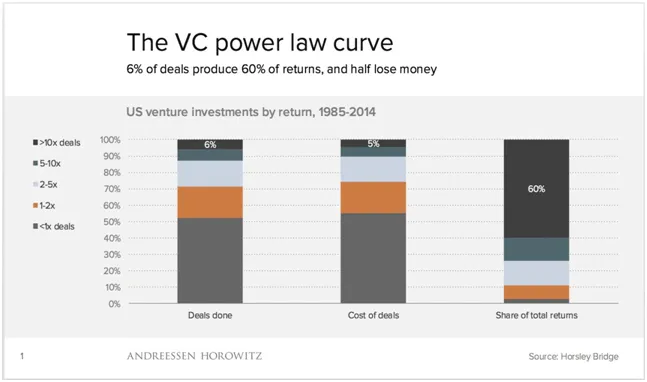

One basic fundamental that every early stage investor should know is that startups follow the law of power - a small percent of the startups you invest in will give you the majority of your profits.

Take for example Andreseen Horowitz’s portfolio. They’re one of the top VC firms - and about 60 percent of their returns comes from about six percent of their deals. What does this tell us? It means to truly make a profit from startup investments, one should be able to access that six percent of deals.

The rest of your investments may or may not materialise significant returns for you - but that six percent of your portfolio is where the return is. If you invest in few startups, it’s like buying lottery.It’s the portfolio approach which helps the early-stage investor create mega returns.

Having given this background, let us come to the question at hand - “Are startups a good investment?” Startups are high risk and high return investments, which follow the power of law. It is not about the number of hits you have, but the magnitude of those hits. That’s where we find the answer to our question. The wealth creation opportunity that startup investments provide is nearly unparalleled. But it is also extremely risky, and conditional.

So, when are startups good investments?

It is a good idea to invest in startups when one has the appetite and the capacity for the high risk involved.An investor with a mission to give first, help founders, and build business will win this game. One must be capable of creating a significantly sized portfolio of investments in the hope that some of the investments are part of the six percent and give one huge return. One can create a startup portfolio by investing about five to ten percent of their total investment capacity in such an illiquid asset class. It is worth noting that the money invested here must be thought of as a sunk cost - until and unless an exit is realised. The investors must be able to stay patient with their capital - the best companies can give returns only after 10 years.

However, the toughest part of investing in startups is gaining access to the top tier of deals that can give you the huge hits.

When one has access to those six percent of deals, it is a great idea to invest in startups. One cannot ascertain at the get go if a particular investment will provide the returns you hope.But one can invest in startups that can give unparalleled returns you hope for if they work out. To gain access to the top startups, one has to put in time and effort to become a part of the startup ecosystem, become a part of various investor networks, and collaborating with other lead investors and VC firms.

Startup investments can also provide disproportionate wealth creation opportunities. Hence, before investing in startups, every investor should ask themselves - Am I ready to take on the capital risk? Do I have the required time and effort to build a portfolio? And finally - Do I have the patience to wait for the disproportionate return?

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)