Why BigBasket is aggressively looking at the hyperlocal delivery space

A highly placed source in Bigbasket, on condition of anonymity, confirmed the company has acquired Pune-based hyperlocal delivery startup RainCan and Bengaluru-based MorningCart. These acquisitions give BigBasket a jumpstart in the hyperlocal delivery segment.

Whether it is investments in the space or bigger players looking at smaller startups, the hyperlocal delivery and foodtech is in the limelight again. The Bengaluru-based e-grocery startup has acquired hyperlocal delivery startups RainCan and MorningCart, a source confirmed to YourStory. He explained,

“The acquisition helps us jump start into the space. They have close to 15,000 customers each and it is a space we are keenly looking at. And why not? The frequency of usage is high, the cost of delivery is lower and there is a high potential to turn it profitable. Also, if you look at it, these startups go beyond just milk, it provides the option for delivery of breakfast essentials like bread, eggs, food and vegetables, which are everyday and weekly requirements.”

With this acquisition, BigBasket has already launched BBDaily on its platform for daily hyperlocal deliveries and needs. "We have also started BBInstant, which is our vending machine service for these daily needs at corporate offices and housing colonies. We already have 60 such machines in Bengaluru," he added.

Interest in hyperlocal delivery was revived in December last year when Google made its first direct investment in Indian messenger service Dunzo. MilkBasket kept the momentum going in early 2018, raising two quick rounds: $3 million in January (Pre-Series A) and in May it raised $7 million.

In these nine months (January to September), hyperlocal startups have already raised $95.86 million across 12 deals. Yesterday, Bengaluru-based hyperlocal, subscription-based delivery startup, DailyNinja acquired Hyderabad-based WakeupBasket for an undisclosed amount in a part cash and part equity deal.

Why the larger players?

Explaining why there is a push for this, Ujjwal Chaudhry, Engagement Manager, RedSeer Consulting said,

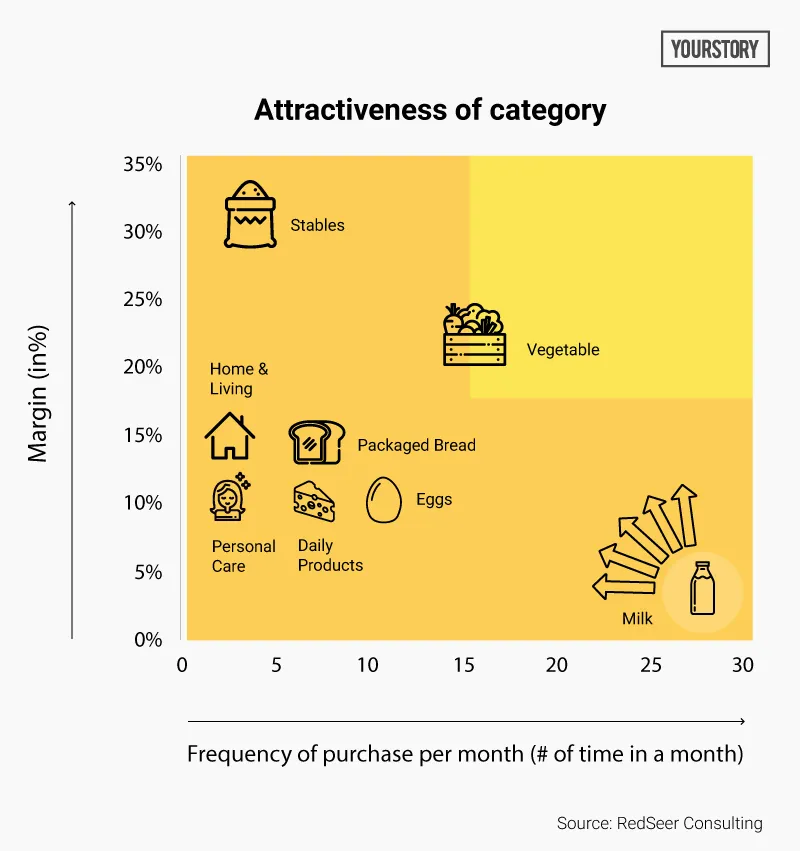

"The reason hyperlocal delivery especially - milk, bread, eggs and groceries is looked at closely by startups and investors is because it gives high customer engagement and also provides more touch points with the end consumer. This model makes it attractive.”

Ujjwal also explained why larger players are looking into this space.

"There are three parts to grocery delivery - the planned purchases, like the supermarket runs for monthly purchase, the regular purchases for last minute needs or sudden needs and then the hyperlocal purchases, like bread, eggs and milk. Most larger players have worked for the firs two, now entry into the third makes it easier.”

Still a tough business

In 2015, a slew of Hyperlocal startups in different segments like Doormint, Peppertap, Turant Delivery and several others couldn't survive the funding crunch towards the end of the year and through 2016.

However, if there was something that the year 2015 taught us, it was that hyperlocal isn't an easy game. Ujjwal said,

"The unit economics for hyperlocal delivery is very tight, the burn becomes high if there is no leash. It is important to keep a tight leash on how much you deliver, the incentives you give your delivery boys, and also the margins for high frequency purchases like dairy products and eggs are generally lesser than the 5 percent to 8 percent. This makes the model difficult to sustain. Therefore, businesses need to work on increasing margins or the order value to keep it profitable.”

What helps is having a captive fleet, and that is what food delivery taught us. But then again this means you need to focus on building the capability, logistics and also manage your headcount.

There is still a lot of evolution ahead for this industry. A large, evolving market like this is bound to be competitive, but at the same time, it provides opportunities for new entrants.

Further, India, unlike any other market, has nuanced systems of credit. Every neighbourhood kirana store has a ledger with households that have a line of credit at that particular store. This is one big disadvantage the online hyperlocal delivery companies have, working as they do with advance payments online or cash on delivery.

"Hyperlocal delivery of this kind also opens up to subscription based models, which ensures better revenue generation," explains a source from BigBasket.