Cloudy and clueless: why SaaS startups are yet to impress in India?

Apart from Freshdesk and three others, software-as-a-service companies are yet to meet their promise of profitability in India. The pricing and customer profile, which is the long tail of SMBs globally, are yet to bear fruit. All these businesses have registered offices and business in the USA, which they say add a lot more to their topline than what the data collected in India suggests.

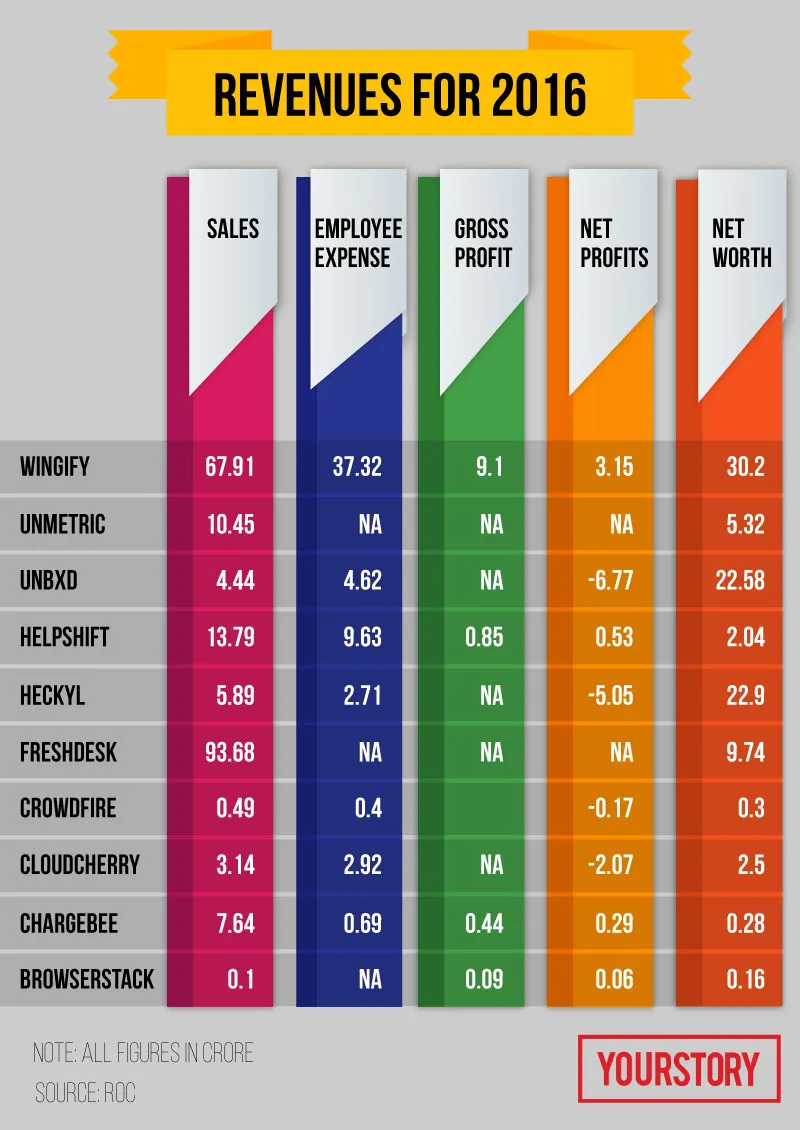

The lack of growth from Indian startups is not just limited to e-commerce. A look at the unit economics reveals that neither the e-commerce industry nor the online education industry stack up impressive numbers. What about the software-as-a-service industry, which everyone believes is doing fine? It too is suffering. Chennai-based Freshdesk is perhaps the only company that can hit a revenue target of more than Rs 100 crore by the end of this financial year. The company has made seven acquisitions and has raised $149 million so far.

Then, there is Wingify, which is a Rs 67-crore-company — as per RoC data — and growing without any external funding. It has made two acquisitions. The other two SaaS companies that have decent revenues are Unmetric and Helpshift. The latter has raised $38.53 million, while Unmetric has raised $8.7 million. All these companies were born in 2010-11, and have grown steadily since. The industry is struggling with low EBITA margins of less than 10 percent, when at least 20 percent margins was expected. Why has the industry belied expectations?

“Today, most companies want to add as many customers as possible. There is more focus on the sale, and they are yet to increase the lifetime value of the customer,” says Yanna Dharmasthira, Research Director at Gartner Inc, adding that SaaS is a model widely being advocated across several product companies, like Microsoft and SAP, too. But the primary difference between these billion-dollar companies and the smaller SaaS companies is that the founders drive the sales in case of the latter, and they have direct relationships with business heads of an organisation. Large product companies work with vendors—like Infosys and Wipro—and sales channels for the product to be implemented. This should help these startups establish a direct connection with brands to cross-sell services.

“The problem is that many startups get short-term contracts. The lack of large revenue streams will lead this industry towards consolidation,” says Yanna.

Perhaps the biggest drop in revenues between 2014 and 2016 was witnessed by Crowdfire. The company’s revenue was Rs 5 crore in the financial year 2015, but dropped to Rs 49 lakh in 2016. The company says they are now a USA registered entity and that the filings in India do not reflect their true nature of their business.

[UPDATE: Nischal Shetty, Founder and CEO of Crowdfire, told YourStory that the above conclusion was "incorrect" for the following reasons: "The data was picked from Codigami Technologies Pvt Ltd which is our old entity (non-operational now) and hence you see the revenue dip. The new Indian subsidiary is Crowdfire India Pvt Ltd and the revenue in that is different from what was reported in the article above. Our revenues are earned in our US entity and hence the revenues in India subsidiary is not a reflection of our total revenues."]

That said the 'stickiness' of the customer is hard to capture and companies are working on increasing their long-term contracts.

“India is going through an evolution, and it is some cycles away from reaching that stage of building great products. We are like Israel was in the seventies -- a country in the services business,” says Abinash Tripathy, founder of Helpshift, a company that brings CRM onto the mobile app.

The top Indian SaaS companies have their businesses focused entirely on North America and Europe.

The Indian industry looks at Zoho as the daddy of cloud-based services and is considered a runaway success. But, there are some goods reasons for their success in their 22-year journey.

“To build a great business you do not need venture capital, at least in our case we always used our own cash reserves to build a great business. What a startup needs is paying customers and a product that is simple and easy to use,” says Sridhar Vembu, co-founder of Zoho Corp.

Sridhar has, in the past, warned the SaaS industry of using external funds to expand operations. He believes that this would divert the ability of the team to build a good software product. “Engineer a good product and customers will spread the word,” he adds. This is how Zoho grew between 2005 and 2010 and the company still continues to grow.

Challenges for the industry

“SaaS companies in India have to go global; if they serve only India then the pricing does not match the profitability, because sales cycles are long to get paying customers,” says Sanchit Vir Gogia, founder of Greyhound Research. The adoption of SaaS services is slow in most industries in India, and the number of paying customers is even lower. The depressing nature of our business models is exposed if one looks at the numbers of the top Indian SaaS companies. So, then, one must really wonder whether the India software product story is here to stay or just vanish.

The only way it can succeed is when the Indian corporate adopts the cloud-as-a-service for business benefit. This would entail corporates moving digital. Currently, just having a website and a Facebook presence with some customer engagement tools by no means creates a digital narrative. Hopefully, in the years to come Corporate India can work with SaaS startups, and offer them longer contracts.

To illustrate this example, Mahindra & Mahindra works with a company called Covacsis to understand the peak load of machines, and has created an intelligent plant framework to make machines efficient. Manjushree Technopack is working with a Pune-based startup to create an intelligent plant framework, where machine data is pulled by software and analysed by plant managers. This allows them to manage production efficiently.

However, the fragmented nature of the Indian industry can destroy the Indian software product dream, because Indian companies are competing with the likes of Zendesk and other global companies. There is, indeed, some truth to the saying, 'Indians believe in the validity of a foreign product.'

The worldwide public cloud services market is projected to grow 18 percent in 2017, to a total of $246.8 billion, up from $209.2 billion in 2016, according to Gartner Inc. The highest growth will come from cloud system infrastructure services (infrastructure as a service or IaaS), which is projected to grow 36.8 percent in 2017, to reach $34.6 billion. Cloud application services (Software as a Service) is expected to grow 20.1 percent, to reach $46.3 billion.

Salesforce.com, which automates the sales and CRM of a company, is the largest SaaS company in the world. Others, like Box, Concur, Zendesk, and CA Technologies are some of the top companies in the SaaS space. Not one Indian company figures on the list of globally valuable SaaS companies. Maybe Freshdesk can do it, but it is left to be seen as to where the next wave of growth will come for the Chennai-based firm.

The question to ask is whether Indian companies are building businesses only to be acquired by large companies like Microsoft, SAP, and Oracle. There are no acquisitions of Indian-registered companies. However, the prediction by analysts is that the SaaS industry in India will undergo consolidation. The numbers are not impressive enough to showcase a long-term growth strategy; the technology itself may fit into a larger offering of a well-established technology corporate.

The pricing is the problem. “There is a price war going on for customer acquisition. So you are really not making money on your service, and the marketing costs are high,” says Yanna of Gartner, adding that in that context the smaller companies are going to suffer because capital is being burned. “But SaaS is here to stay and enterprises see the benefits of the cloud,” she says.

Hopefully, Indian SaaS companies become Rs 100-crore companies like Freshdesk and Wingify to take on the global competition.