Why should GST strive for revenue neutrality?

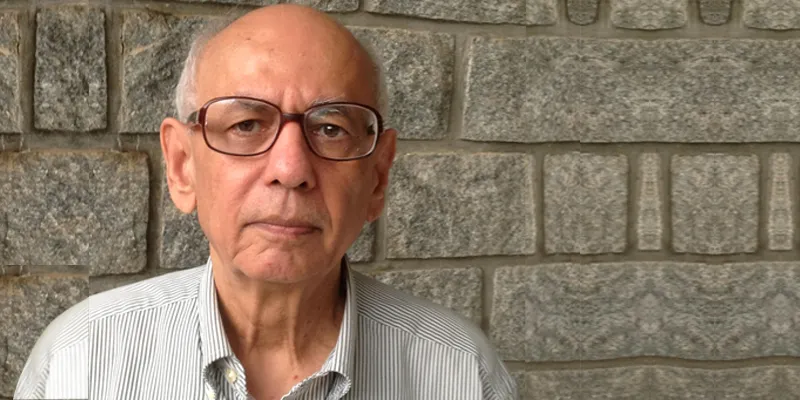

Mukul G Asher is a professorial fellow of the Lee Kuan Yew School of Public Policy at the National University of Singapore. A fiscal economist, he had worked on Indian public finance issues and advised Asian governments on VAT (Value Added Tax) and other taxes. His Global Village Foundation, based in Delhi, engages with state governments on tax policy. Here is a lightly edited primer on the Goods and Services Tax (GST), which is likely to get legal backing in the Rajya Sabha this week.

Related read: 7 years late, but GST can finally be a reality by next April

YS: Governments want to collect the same amount of tax as they do now through GST. Why should we be excited about it if the tax burden increases or remains unchanged?

Mukul Asher: We have a distorted system right now. There is no need to set a rate which gives you revenue neutrality because why would you want to duplicate a distorted tax system’s revenue? The rate should be set such that it improves India’s competitiveness, with some revenue needs in mind. GST will improve compliance, widen the tax base, make the economy more efficient and reduce compliance cost for businesses.

The phrase ‘game changer’ is often mentioned with GST…

Mukul Asher: GST is a goods and services tax. Both should be taxed uniformly at both the central and state levels. Our constitution does not allow that. (Services cannot be taxed by states, now). So it is a major reform. Revenue is one aspect of tax reform. The main purpose is reducing compliance cost, improving logistics or the number of days it takes for a truck to go to its destination without being held up at entry tax and octroi collection posts, and making our tax system compatible with international practice where goods and services are taxed at the point of consumption

If compliance is going to improve should not the rates be lower than now?

Mukul Asher: Our competitors in Asia have rates of 10-12 percent. The average OECD (the club of mainly rich countries) rate is 18.6 percent. We have over-relied on domestic goods and services taxes through sales tax (of VAT), excise duties, entry tax and service tax (as compared to income or corporation tax). So somewhere around 18 percent would be a reasonable rate.

We pay 15 percent on services. Isn’t 18 percent going to be inflationary?

Mukul Asher: The upper half of the income group spends a greater proportion of their budget on services. It is the lower half that spends more on goods. If the upper half pays more, it will bring progressivity to the tax system.

Who spends how much on GST will depend on the nature of consumption of a household.

Mukul Asher: That’s right. That is why it is difficult to calculate the revenue neutral rate because the dynamics are changing.

Also read: How will the GST impact your startup business

The champions of GST like industry chambers and the government say there will be an increase in GDP growth rate because of GST.

Mukul Asher: There is no evidence in international experience that introducing GST in itself will raise GDP. But growth will be influenced by greater efficiency and compliance levels, improved logistics and supply chains, and alignment with international tax practices. All this will have an indirect impact.

When VAT was introduced we were told it would end multiplicity of taxes at the state level. But states have levied entry taxes on goods from outside sold within their territories. You gave the example of Canada (at a seminar organised by Swarajya magazine in Bengaluru), which is held as a model for India. But you quoted the Economist magazine, which says that tax barriers created by Canadian provinces cost the nation $10 billion annually. What is to prevent the states and the centre from introducing cesses after GST?

Mukul Asher: It is possible because ultimately tax and expenditure are political economy decisions. GST is likely to constrain them, which was not the case with VAT, as states will lose competitiveness (if they levy additional taxes). GST is not an event. It is a continuous process. Provinces or states will always find creative ways but the extent is much less.

States seem to be reluctant. Should they not be eager for GST?

Mukul Asher: Yes. States do not have the power to tax services today. In most states, services are more than 50 percent of their economy. When you have the power to tax 50 percent and the union government is saying it will compensate you for five years (for revenue losses, if any), why would you not go for it?

Will e-commerce companies benefit or not?

Mukul Asher: E-commerce is one part of the larger digital economy. There is a perception, and I think a correct perception, that the current GST draft law does not take a more sophisticated, futuristic view of the digital economy and they should revisit it when the GST bill is tabled in Parliament.

The tax director of an ecommerce company was worried about the provision in the draft GST bill that makes them collect tax at source on behalf of their vendors.

Mukul Asher: Right now the focus is on getting the constitutional amendment bill passed. After that, these details will be sorted out. The transition provisions have not been so well spelled out. There could be greater clarity.

Will GST increase the amount of tax collected?

Mukul Asher: Currently we collect close to 7 percent of GDP through taxes on goods and services. How much more GST can do will depend on the rate, the base and whether petroleum products and alcohol are included in it.

What is the percentage in OECD countries?

Mukul Asher: It is 6.6 percent on average.

YS: So there is not much scope for increase?

Mukul Asher: Not if we want an internationally competitive rate. A good principle is to have as broad a base as possible and as low a nominal rate as possible.

You may also like: Model GST – Not a curse but a lesser boon

YS: A few companies are likely to contribute most of GST revenue. The 80:20 principle will apply. Does it not make sense to exempt entities with low turnover from GST?

Mukul Asher: Different countries make different trade-offs. The perception in many Indian states is if you have a large number of assesses it is good. They are not looking at the revenue risk. A lot of our auditing procedures in the tax department are not risk-adjusted revenue procedures. They are based on some ad hoc rules. States will have to create an environment where businesses want to locate and not move away.

What kind of change in attitude on the part of tax officials will GST require?

Mukul Asher:The officials must strive for maximum voluntary compliance. They will have to create the environment, the auditing procedures and they will need the skill sets to facilitate voluntary compliance. Right now that is not very evident. There is a distinction between ruling and governance. They have been using coercive powers to get compliance but governance means facilitating voluntary compliance.

By the same author: