India Stack - A change agent for government, startups and corporates to serve citizens

Six months ago, when Bill Gates, Chairman of Microsoft, visited Bengaluru and met the iSpirit team, he was curious about 'India Stack'. He was also eager to know about the rapid pace at which the country managed to register 95 percent of its citizens on an identification database called Aadhaar. The volunteers of iSpirit—a software product think tank—obliged and a crack team consisting of Nandan Nilekani, Pramod Varma, Sanjay Jain along with Sharad Sharma, Founder of iSpirit, made a presentation to Gates about India’s digital revolution waiting in the wings.

In the end, Gates saw the 'India Stack' as the shining beacon of technology to propel change. He is known to have used the words “cutting-edge” and was overheard saying, “there are few countries which can boast of a digital infrastructure as sophisticated.” He added that the vision of transforming India through application of technology had received new impetus.

On India Stack, Nilekani, Co-founder of Infosys and former Chairman of Unique Identification Authority of India (UIDAI), says, “This is a technology platform that delivers complete services to citizens transparently and is focussed on improving lives.”. He adds that it was a product of several years of innovation starting with the UIDAI’s Aadhaar platform. “This is India’s single most important innovation to formalise India’s domestic economy through digital services,” he says.

What is India Stack?

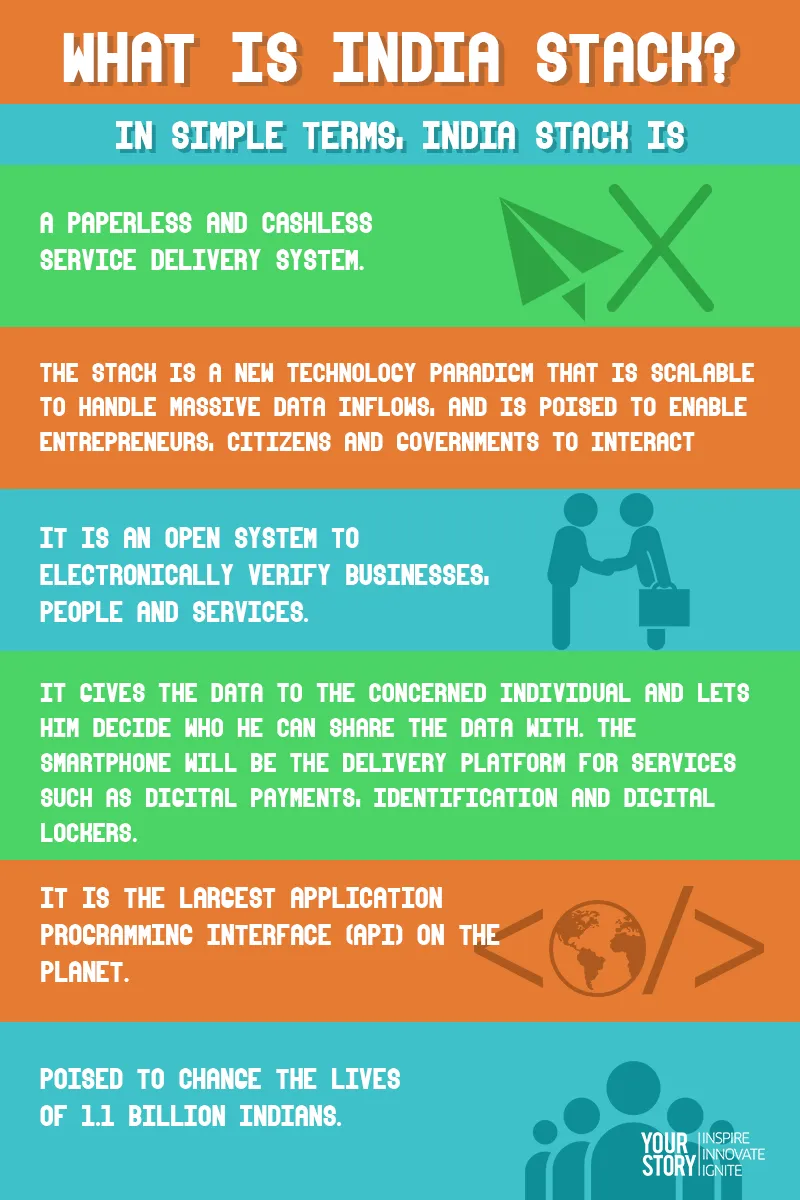

In simple terms, India Stack is:

- A paperless and cashless service delivery system.

- The stack is a new technology paradigm that is scalable to handle massive data inflows, and is poised to enable entrepreneurs, citizens and governments to interact with each other transparently.

- It is an open system to electronically verify businesses, people and services.

- It gives the data to the concerned individual and lets him decide who he can share the data with. The smartphone will be the delivery platform for services such as digital payments, identification and digital lockers.

- It is the largest application programming interface (API) on the planet.

- Poised to change the lives of 1.1 billion Indians.

This open API policy was conceived around 2012, when the Central government realised that it cannot deliver citizen services on its own efficiently. So it proposed, based on its experience with Aadhaar, an open-data initiative supported by an open API policy, which would pave the way for private technology solutions to build services on top of Aadhaar. This was a significant development because it was the first time that the government conceded it needed entrepreneurs to build on top of a stack to deliver services.

Here are the 5 tenets of India Stack and the Startups leveraging it

Paperless identification: Aadhaar’s 12-digit unique identification number, floated by the UIDAI in 2009, has more than one billion Indians registered who have became the basis for the India Stack. The government uses the platform to transfer subsidies directly into the beneficiaries' accounts. Today, Jandhan Yojana (the subsidy scheme) and Aadhaar, along with mobile, are termed as the JAM trinity for public services. The JAM has delivered direct benefits of Rs 61,000 crore in the form of fertilizer subsidies and other welfare schemes. Over 190 million accounts have been opened so far as per records available on Jandhan website. All these accounts have been opened after using Aadhaar, which has helped beneficiaries receive money in their accounts.

“The advantages of such a system are that all leakages in the subsidy and welfare system disappear,” says Nilekani.

This system of identification and delivery of services is already being used by the startup world. One only has to visit the 50,000 merchants aggregated by Novo Pay to understand how money transfers happen digitally for citizens with the aid of the local kirana store. Novo Pay uses the Aadhaar platform to verify citizens to enable them to open bank accounts or transfer money to any bank across the country, or make payments for bills or buy products through the kirana network.

“We use Aadhaar to deliver banking services to citizens. Novo Pay’s network operating centre also tracks the business cycle of each kirana which gives them an overview of the financial services that consumers experience,” says Srikanth Nadhamuni, Co-founder of NovoPay. In the future, the company can also work with banks to verify and provide loans to people through the kirana network. “We are going after the long tail and it is a business that takes years to build, which when it reaches critical mass can change financial services in the country,” says Nadhamuni. The smartphone can also become central to verification because all the information goes to the registered phone number.

Paperless payments: Novo Pay also allows mobile payments through the smartphone. This can become India Stack’s signature delivery mechanism to make India a digital cash economy. The paperless payment is a brainchild of the National Payments Council of India (NPCI), which is a consortium of Indian banks. This organisation along with iSpirit floated the Unified Payments Interface (UPI), which will make mobile payments cardless and completely digital. It will break the back of foreign payment platforms or switches (MasterCard and Visa), which so far charged high commissions to settle rupee transactions.

The UPI allows consumers to transact directly through their bank account with a unique UPI identity, which syncs to Aadhaar’s verification and connects to the merchant, the settlement and the issuing bank to close a transaction. In a single swipe the transaction is complete, without any middleman (like the Visa and Mastercard switch) to facilitate the transaction.

Here is an explanation of how this system works.

There are several companies offering paperless payments today, like PayTM, FreeCharge and MobiKwik. There is a startup called FonePaisa, which is aggregating all payment apps under one platform to pay the kirana or any business. YourStory reported first on how Flipkart can use PhonePe, a startup that it acquired, to enable payments through the UPI. Let us say that the consumer is browsing through a catalogue and he finds his favourite product. He opts to pay through the UPI method. Flipkart’s system asks the consumer for his or her UPI identity and the consumer inputs it. Then, a bank notification pops up on the Flipkart app or in the bank’s app asking the consumer to authenticate the transaction. The consumer inputs his fingerprint as authentication and the transaction is settled between the banks, the e-commerce company and the customer.

“Most of us are building this form of payment for even retail transactions. Imagine that this system can bring 50 million mom-and-pop stores online and they can accept digital payments because of the UPI,” says Ritesh Agarwal, Co-founder of FonePaisa, adding that India will have a hybrid payments industry and that there will not be any one payment stack that will remain popular.

However, the UPI will benefit Indians who have never experienced digital payments, and is clearly focussed on bringing 900 million Indians into the digital fold. “The only problem with the long tail is cultural. Will people begin to trust digital cash over physical cash? It becomes a hard habit to break. However, it is an opportunity nevertheless,” says Sarath Naru, Managing Partner of VentureEast.

Paperless documents: Although digitisation is growing, India consumes the largest amount of paper. According to corporate ratings and research agency India Ratings, the per-capita consumption of paper is 9kg and is all set to double by 2020 because of the growth of the education industry. But with smartphone prices dropping, at least financial services and the healthcare industry can move to a paperless scenario in major cities with the help of India Stack. The Stack’s APIs allow startups to bring solutions that can make documents go digital.

A large consumer goods company can use the India Stack to file taxes and track the filings made by its entire ecosystem, of distributors or dealers to reconcile taxes, to avoid legal complications arising from double taxation. This automated service provided by startups with the India Stack gives the corporate a dashboard and performance analytics on the right amount of taxes paid and owed. Startups like Clear Tax and Tax Mantra can provide this scalability by using India Stack. The platform can also be secured for each corporate with their own digital identity. The use cases for paperless documents are plenty.

E-KYC: Today, many banks are yet to insist on an e-KYC (electronic Know Your Customer) on their platforms. However, when they integrate their infrastructure with India Stack, the Aadhaar number becomes the defacto KYC. Prepaid digital wallet Oxigen allows e-KYC. Axis Bank has allowed Aadhaar to become the e-KYC platform across all its 2,000 branches.

“A key challenge for the customers while opening bank accounts is providing address proof, identity proof and physical copies of documents. E-KYC simplifies the customer experience for the Aadhaar-registered individuals to open bank accounts” says Shikha Sharma, CEO of Axis Bank. Only the top 50 banks in India have agree to make e-KYC a norm.

Digital signature: This would be the last mile to cross, and can be made simple between two or more parties executing contracts over the mobile. Individuals or entities can use the Aadhaar ecosystem to send digital signatures on a certified or legal document. Today, most HR offers are online documents that contain digital signatures. But there is a single source of paper still. Imagine, if the entire document is a digital template. When an employee has to accept an offer, he sends the document duly signed by a digital signature. This has several applications too.

A road not far away

In many ways, India is a complex nation. It has cultural differences, yet technology seems to be the tool that can break barriers. Yet, England’s exit from Europe signals a new shift in the world. It is fast becoming a world that is shrinking back into nationalism and protected markets. India has a huge domestic market where services can be streamlined with the help of technology. Any delay on that front can be detrimental, in the form of lack of education and healthcare. “India is a nation of extremes. We are solving problems, but the services aided by technology must reach a larger mass of people faster,” says S D Shibulal, Co-founder and former CEO of Infosys.

Perhaps the time of change is now. If Bill Gates can see it then all India institutions should get together and use India Stack to bolster the nation's prosperity.