Why startup founders should be good at ‘balancing’ these two business concepts

How to keep customers happy – this question might be keeping startup founders up at night. But before this good-to-have worry comes another question – how to acquire these customers?

Though it is expected that every entrepreneur must have confidence in his/her product and be optimistic about the acceptance in the market, it is not sensible to assume that the customer will come knocking on the company's door asking for it.

What is important at the initial stage of business development is building a viable business model, keeping in mind all costs involved. In the case of startups, the focus mostly comes to balancing two variables:

- Cost to acquire customer, which is Customer Acquisition Cost (CAS)

- The ability to monetise those customers, which is Lifetime Value (LTV) of a customer

Customer Acquisition Cost is the cost incurred by the organisation to acquire a potential customer. It’s the cost associated in convincing a customer to buy a product/service. This cost is inclusive of the product cost as well as the costs involved in research, marketing, and accessibility costs.

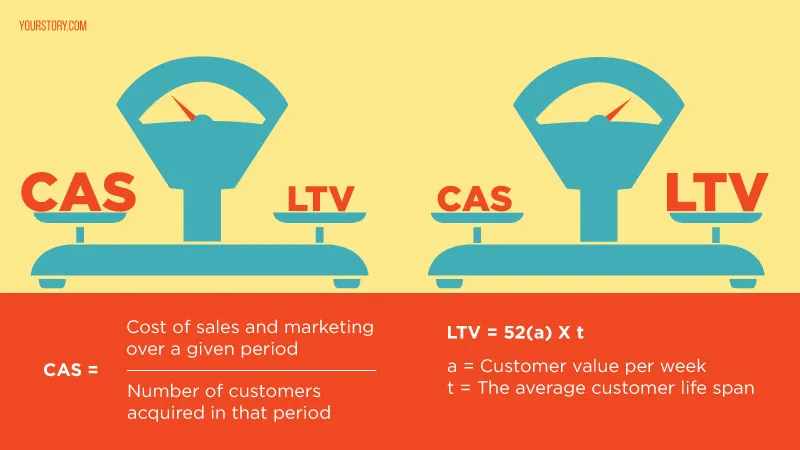

To compute CAS, we take the entire cost of sales and marketing over a given period, including salaries and other headcount-related expenses, and divide it by the number of customers that were acquired in that period.

Lifetime Value (LTV) of a customer can be referred to as the gross margin that we would expect to make from a customer over the lifetime of the business relationship. Roughly defined, LTV is the projected revenue that a customer will generate during their lifetime with the company. The calculation will vary with every business model. If we take the example of a coffee shop, it will calculate customer value by multiplying averaged-out variables like expenditure per visit and visits per week and measure it over the average lifetime.

There are various equations for calculating LTV, depending on the business model.

Many startups that have impressive and compelling solutions to problems fail to focus on the cost of acquiring new customers and work on vague figures in mind. A viral growth is what all businesses fancy but reality is miles away.

Gradually, businesses realise that spending for customer acquisition is unavoidable and are not-so-pleasantly surprised when they learn of the soaring costs associated with search engine optimisation and marketing, public relations, social marketing, direct sales, channel sales etc.

Eventually, the cost of acquiring customers turns out to be higher than expected, and exceeds the ability to monetise those customers.

It doesn’t take an expert to understand that business model failure comes when CAS (the cost to acquire customers) exceeds LTV (the ability to monetise those customers).

A well-balanced business model is one where CAS is lower than the LTV.

Building a viable business model

While working on a business model, it’s very important to closely monitor and accurately calculate the costs of acquisition. Mostly, this cost will depend upon:

- Cost per lead

- Conversion rates at each stage of your sales process

- Level of touch required

The CAS has to be compared with LTV and the following guidelines should be adhered to

- LTV should be more than CAS (advisable to keep LTV upto or more than 3X of CAS)

- Aim to recover the CAS in under 12 months. Otherwise, the business will require too much capital to grow.

Conclusion

In the initial stage of the business, it’s not possible to calculate accurate conversion rates. This is a challenge to businesses to constantly work and update their numbers till they come to correct calculations.

Conversion rates play an extremely important role in managing the CAS. Anything that improves the conversion rate keeping costs low should be done to bring the CAS down. For example, using customer reference to avoid trials, creating demo videos to address likely sales questions, or any other such innovative method should be taken up depending on the nature of business.

The good news is that since the web has provided some amazing new ways to acquire customers at considerably low cost, the only thing that businesses have to consider is monetising customers at a higher level than mull over the cost to acquire them.

The business is deemed to grow and succeed if it is able to monetise its customers at a higher rate than the cost of acquiring the customer.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)