Flipkart and Amazon both claim they are the leaders. Who do you believe?

It is good fun for the rest of us - industry watchers, insiders and consumers - when two business giants battle it out in public. The Coca Cola-Pepsi brand wars kept us entertained for much of the 1990s and early 2000s; now it is the turn of e-commerce majors Flipkart and Amazon.

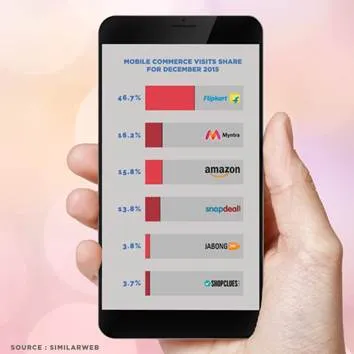

The $15 billion-valued Flipkart has issued a statement saying its platform got 47 per cent of the total mobile commerce traffic for December 2015, according to data from SimilarWeb, a web analytics venture. The SimilarWeb data further states that Myntra occupies the second position with over 16 per cent share of visits, which means the Flipkart-Myntra combine had a traffic share of 63 per cent. Flipkart's nemesis Amazon comes in third with 15.86 per cent share followed by Snapdeal with 13.84 per cent.

This can be considered an obvious response to Amazon's statement in November 2015 that it was the highest visited website in October, during the festive sales period, with 200 million visitors, according to comScore data. Amazon CEO Jeff Bezos sent a gushing email to millions of the site's Indian consumers in December after the comScore numbers. He said,

Just two and a half years from our launch, Amazon.in has become the most visited ecommerce site in India. This customer response continues to amaze and energise us.

A Rs 200 gift voucher also accompanied the email to customers.

Flipkart, then, did not respond. However, Flipkart officials have pointed out that comScore numbers do not really reflect the mobile traffic. Flipkart, since early-2015, has focused on a mobile-first strategy placing its hopes primarily on the app. About 75 per cent of Flipkart's traffic comes from mobile.

The Flipkart statement claimed that it leads in app installs as well, with an install base of 37 per cent of the total Android smartphone user base in India. Its fashion subsidiary, Myntra, has an install base of 10 per cent. Amazon and Snapdeal, the Flipkart statement claimed, have an install base of 18 per cent each.

The fact that this is a response to Amazon's claim of being the most visited e-commerce website is clear when we read the following points in the statement:

The Indian e-tail market is overwhelmingly mobile dominated with around 70 per cent traffic coming from mobile devices. Desktop contributes to only around 30% of the total traffic, a share that has been declining rapidly.

YourStory take

Flipkart, Amazon and Snapdeal are battling it out on multiple fronts, from getting exclusive brands to offering steeper discounts. Leading newspapers had multiple full-page ads taken out by all three during the festive season. Earlier, when Flipkart had announced it $1 billion funding, Amazon had followed it up with an announcement of a $2 billion investment into India operations. The user number 'battle' is just the latest. While these announcements might help in building perception, the fact is that the data put out by agencies like comScore and SimilarWeb have been disputed for years. Numerous questions and answers on It is good fun for the rest of us - industry watchers, insiders and consumers - when two business giants battle it out in public. The Coca Cola-Pepsi brand wars kept us entertained for much of the 1990s and early 2000s; now it is the turn of e-commerce majors Flipkart and Amazon. The $15 billion-valued Flipkart has issued a statement saying its platform got 47 per cent of the total mobile commerce traffic for December 2015, according to data from SimilarWeb, a web analytics venture. The SimilarWeb data further states that Myntra occupies the second position with over 16% share of visits, which means the Flipkart-Myntra combine had a traffic share of 63%. Flipkart's nemesis Amazon comes in third with 15.86% share followed by Snapdeal with 13.84%. This is an obvious response to Amazon's statement in November 2015 that it was the highest visited website in October, during the festive sales period, with 200 million visitors, according to comScore data. Amazon CEO Jeff Bezos sent a gushing email to millions of the site's Indian consumers in December after the comScore numbers. The Amazon CEO said: "Just two and a half years from our launch, Amazon.in has become the most visited ecommerce site in India. This customer response continues to amaze and energise us." A Rs 200 gift voucher also accompanied the email to customers. Flipkart, then, did not respond. However, in meetings Flipkart officials have pointed out that comScore numbers do not really reflect the mobile traffic. Flipkart, since early-2015, has focused on a mobile-first strategy and has placed its hopes primarily on its app. The Flipkart statement went on to claim that it leads in app installs as well, with an install base of 37 per cent of the total Android smartphone user base in India. Its fashion subsidiary, Myntra, has an install base of 10 per cent. Amazon and Snapdeal, the Flipkart statement claimed, have an install base of 18 per cent each. The fact that this is a response to the Amazon claim last year of being the most visited e-commerce website is clear when we read the following points in the statement: "The Indian e-tail market is overwhelmingly mobile dominated with around 70 per cent traffic coming from mobile devices. Desktop contributes to only around 30% of the total traffic, a share that has been declining rapidly." YourStory take Flipkart, Amazon and Snapdeal are battling it out on multiple fronts, from getting exclusive brands to offering steeper discounts. Leading newspapers had multiple full-page ads taken out by all three during the festive season. Before that when Flipkart had announced it $1 billion funding, Amazon had followed it up with an announcement of a $2 billion investment into India. The user number 'battle' is just the latest. While these announcements might help in building perception, the fact is that the data put out by agencies like comScore and SimilarWeb have been disputed for years. Numerous questions and answers on Quora are focused on the reliability of such data. This is because finding out how many users visit a site - on mobile or on the desktop/laptop - is not so simple (Click here to read more about the complexities involved with finding online user numbers) Note: The visit share has been computed by comparing visits among top shopping apps – Flipkart, Myntra, Amazon, Snapdeal, Jabong and Shopclues, as reported by SimilarWeb for December 2015. ABOUT FLIPKART Flipkart is India’s largest e-commerce marketplace with over 60% market share in mobile commerce. With a registered customer base of 50 million, Flipkart offers more than 30 million products across 70+ categories including Books, Media, Consumer Electronics, Furniture and Lifestyle. Flipkart is known for its path-breaking services like Cash on Delivery, experience zones and a 30-day replacement policy. Flipkart was the pioneer in offering services like In-a-Day Guarantee (50 cities) and Same-Day-Guarantee (13 cities) at scale. With 80,000 registered sellers, Flipkart has redefined the way brands and MSME’s do business online. Launched in October 2007, Flipkart has become the preferred online marketplace for leading Indian and international brands and is valued at $15.2 billion today. Over 75% of Flipkart’s traffic come via the mobile device and with industry leading introductions like Ping, Image search, and Flipkart Lite, Flipkart has revolutionized digital shopping in India. Clocking over 10 million daily visits, Flipkart’s technology has enabled it to deliver 8 million shipments per month. are focused on the reliability of such data. This is because finding out how many users visit a site - on mobile or on the desktop/laptop - is not so simple (Click here to read more about the complexities involved with finding online user numbers). Even if we keep data reliability aside, user numbers should not be the metric with which we judge these e-commerce giants. The focus should be on actual sales and, dare we use the word, profits.