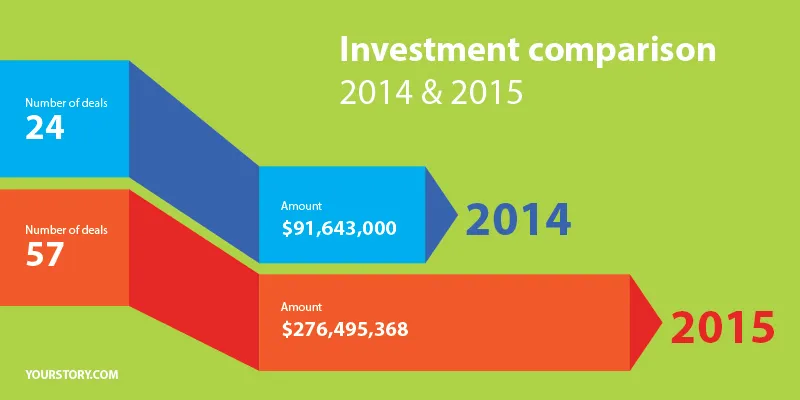

With $277M in funding and 57 deals in 2015, here’s what to expect from healthcare in 2016

The healthtech space has grown steadily in the past 12 months, not just in terms of funding but also in the number of deals.

Even in terms of percentage share, investor interest in healthcare in the world’s second-most populous country has never been so high. Market experts attribute this increasing interest to a host of factors, including wider profit margins, increased demand for generic drugs, and M&A activity in the sector. Analysts remain bullish on the sector, saying the heightened interest will be sustained in the near future. (Source: IBEF and PwC).

Data for 2000-2015 from the Department of Industry Policy and Promotion shows FDI investment in hospitals and diagnostic centres totalled $3.21 billion. According to IBEF, the healthcare market in India was worth close to $100 billion as of 2015 and is expected to touch $280 billion by 2020, clocking a CAGR of 22.9 percent. Of the overall market, the healthcare delivery sub-segment accounts for 65 percent.

Preventive healthcare is in

InnAccel, a med-tech-specific accelerator that aims to drive innovation in the medical devices space, says that close to 90 percent of startups they evaluated in 2015 were working on preventive and monitoring-based healthcare solutions.

Companies that were invested in this year include search-and-discovery platforms such as Lybrate and Practo, diagnostic test aggregators, wellness marketplaces, home healthcare firms like Portea and personalised nutrition coaches, all of which are available via apps. There are also apps enabling video-based consultations with specialists and medical advice from doctors aggregated to give patients the best diagnosis possible remotely, like with Doctors Circle.

Dr. Abdur Rub, Co-founder of Xcode, a health genomics company, working on personalised, DNA-based wellness programmes, says that 2015 saw the healthcare and health-tech spaces evolve rapidly.

“Some of the key trends seen this year are deeper penetration of IT in various aspects of healthcare. There has also been greater awareness and adoption of preventive healthcare using technology-based devices by consumers,” adds Abdur.

Where is the focus on understanding real problems?

Preventive medicine is clearly a sector where we are likely to see a lot more activity in 2016. However, several doctors and healthcare professionals believe that we still have a long way to go in terms of focussing on technology that would work around real problems.

Dr. Jagdish Chaturvedi, Co-founder of InnAccel an ENT surgeon, a Stanford-India Biodesign Fellow 2012, and a serial MedTech innovator (18 devices, one licensed to Medtronic) with core expertise in identifying and analysing unmet clinical needs using the Stanford Biodesign process says:

“I believe at present there is a greater need for technologies that treat and diagnose patients rather than preventive and monitoring solutions. Over the last few months we have also seen more mature teams/entrepreneurs (with over 5-8 years’ industry experience) taking up med-tech challenges and spinning different startup companies and seeking seed capital. However, apart from the technologies we are developing at InnAccel and a few others outside, we are not seeing many therapeutic and diagnostic solutions for pressing clinical conditions.”

Jagadish adds that a well validated and understood clinical need is the most crucial element for any healthcare technology. He adds that today, most entrepreneurs who interview clinicians to identify pressing needs hardly spend any time in the hospital actually observing and understanding the clinical problems. The lack of in-depth understanding of clinical gaps, he says, leads to the development of vague and non-specific healthcare technologies.

Keeping an open mind

The InnAccel, database shows around 97 startups listed in India who are addressing healthcare needs. However only 15-20 of them are actually solving real healthcare problems that have been well understood and thoroughly validated. The rest are working on less specific and poorly understood needs that have either been self-felt needs or needs derived from doctor interviews.

Backing Jagdish is what Viren Shetty, Director of Strategy, Narayana Hrudayalaya Hospitals, said in a panel,

“There are many times when the startups come in and pitch an idea. They believe that they have the perfect solution and aren’t open to listening. For the hour we meet, almost 80 percent of the times they will be talking and they don’t listen. It’s important to have an open mind.”

K. Chandrashekhar, CEO of Forus Healthcare, says that implementation of a problem is the key. “It is the most non-glamourous part. You need to be on the field understanding what will help people use that technology – why they are or aren’t using it – and make all those minute and relevant changes.”

Technology gives health-tech a level playing field

“We have seen every company capable to see its success by addressing one of these need gaps. The biggest challenge yet being availability of doctor in a country where Doctor - Patient ratio is 1:1800 in a country wide average and most specialists available only in metros,” adds Anand.

Chandrashekhar, adds that technology has to play a levelling ground and there can be no two ways about it. “But it all depends on the kind of technology you are using and the kind of problem you are solving. If you understand the problem and solve that problem with the right technology, then the task becomes simpler.”

Are there biases in play?

Abdur adds that startups are setup with an intent to solve an existing problem in the healthcare space but many have a biased perception of how big a problem is it that they are solving. They need to ask themselves if in solving one problem they are deviating too far from established behaviours and institutional practices, thus creating additional problems while solving some.

These aspects are not easy to get and need someone with deep domain expertise in healthcare and develop viable solutions. One thing that is lacking today is the absence of deep domain expertise in the teams, though funding has been aplenty.

Hardware – a tougher nut to crack

A hardware solution has a longer gestation period than a software or an app-based solution. There needs to be a focus on a problem that is big enough and has space to build a product. K. Chandrashekhar adds that there also are other entry barriers like clearances and huge amounts of investment that need to be sorted out.

“Also, if you want to make a global hardware product, it needs to work not only on an Indian but an actual global problem. Thus, there needs to be a deeper knowledge base of the problem and even the solution,” adds K. Chandrashekhar.

IoT ushers in wearables

While the devices might be moving at a slightly slower place, towards the end of this year, there was also a lot of buzz around the space of wearables with Moto 360, FitBit’s formal launch in India and GoQii getting invested in by Cheetah Mobiles.

“There is a definite shift towards empowering people with tools, devices and wearable technology to create personalised interventions and even helps them to screen themselves,” adds Ankit Khambhati, Founder HoD Life. He adds that with most of the wearable technology, people can take health into their own hands.

The data that one gets out of these devices can, in turn, be used by hospitals and diagnostic centres. In fact, end consumers themselves can be trained in reading the data and come up with a basic analysis.

Shift in focus to tier II and III cities

The IBEF report adds that rural India, which accounts for over 70 per cent of the population, is set to emerge as a potential demand source. Anand Chatterjee, Founder and CEO TopDoctorsOnline says, “We have also learnt from our data that as we go deeper in the country in Tier II and III cities, the need of solutions grow manifold, and consumers in small towns and cities welcome such innovations whole-heartedly.”

Consumers get health conscious, and how!

However, even with the accessibility and advances in technology, adoption of tech has not been very straightforward. Abdur adds that the consumer today has become more knowledgeable and proactive about this own health and hence, there is early adoption of a number for a number of IT, Device tech and telehealth platforms.

YourStory take

If you look at the top 20 startups that got funded, the list seems to heavily inclined towards preventive and convenience plays-

However, there has been a growing awareness and shift towards healthcare and med-tech solutions that solve real, on-the-ground problems. According to the Ministry of Health, in FY 16, over 50 technologies are being developed for the treatment of TB, cancer and several other diseases.

Apart from this, Manipal Hospitals’ corporate and teaching facilities are set to adopt ‘Watson for Oncology,’ by IBM. It is a cognitive computing platform that is trained by the iconic Sloan-Kettering Memorial Hospital; it analyses data to identify different treatment options and personalise healthcare for cancer patients.

There are several other government-led health initiatives as well. India signed a five-year MoU with Sweden to foster cooperation in the healthcare sectors to help fill the gaps in innovative technology and research to help provide quality healthcare.

It would be difficult to state the success of healthtech in a single line; it is also too early to measure its impact. 2015 has been the first year when tech has been perceived to be able to address gaps in the healthcare industry, from the availability of doctors to getting second opinions and options of delivery of medicines. Overall, it seems safe to claim that 2016 will be an interesting year for both healthcare and health-tech.