Funding roundup: November begins with a dip in startup fund flow

Radhika P Nair

Monday November 09, 2015 , 3 min Read

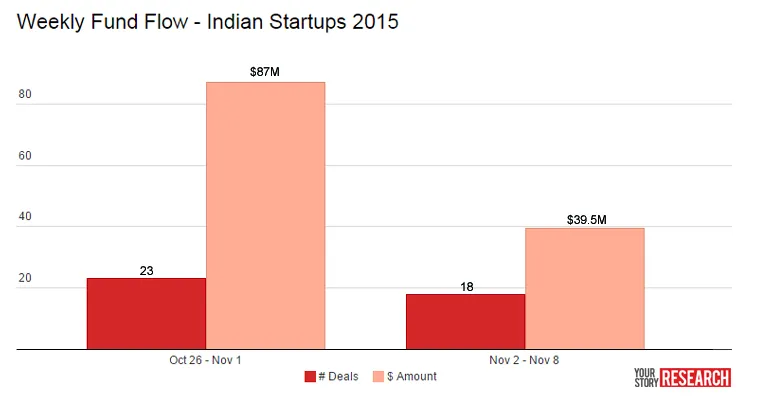

Investors and industry insiders have been cautioning entrepreneurs about the coming ‘winter’ in investments for some time now. In the last week of October, 23 companies raised $87 million. In the first week of November, the value was less than half ($39.5 million) that of the previous week. This difference can be chalked down to one deal—online pharmacy Netmeds announced a $50 million fund-raising round in the last week of October. The number of deals also came down, with 18 startups announcing fund raises in the first week of November. However, we cannot yet be sure that this is the beginning of a slowdown; deal flow in the coming weeks will tell us that.

A majority of the deals—around 10—are in the seed and Series A stages. Online skills marketplace FindYahan and cloud communication platform Sabse did not disclose deal details.

The past few weeks have been pretty traumatic for hyperlocal, especially foodtech, startups. Foodtech startups like Dazo and Spoonjoy shut shop. The startup world was then shaken by the news of food delivery firm TinyOwl drastically scaling back operations, leading to heated confrontations between employees and management. While all this was happening, about seven hyperlocal startups raised funding, including early-stage foodtech companies like Twigly, Boibanit, and Stuffed.

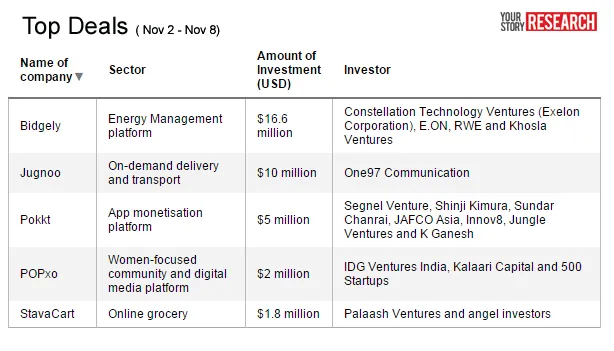

However, the top five companies by deal value came from diverse sectors. Bidgely, which stands for the Hindi word for electricity, was the top fund raiser mopping up $16.6 million from Constellation Technology Ventures, the investment arm of US-based energy generator and distributor Exelon, European electric utilities firms E.ON and RWE and existing investor Khosla Ventures. Four-year-old Bidgely’s products help energy utilities build customer loyalty and customers save energy. The company is based out of Bengaluru and California.

Startups have become voracious acquirers of other startups. The M&As announced during the first week of November fell in this category. Of the four acquisitions, three deals were of firms acquiring a competitor. Wassup, which currently focuses on laundry, intends to become a horizontal service provider. It acquired Chamak, which in all likelihood will become Wassup's laundry executor. Home services startup Taskbob’s acquisition of competitor Zepper will help the former enter the Bengaluru market; similarly online wellness classifieds and booking platform Gomalon gets access to a large set of vendors and a readymade customer base through BookMySpa. Wassup and Gomalon have ended up buying companies launched before their founding. Exotel, a cloud telephony company, acquired Voyce to allow the former’s clients collect customer feedback easily. Like most startup deals these too were equity deals.

The relatively lower number of deals in the first week of November, compared to the previous week is not yet a cause for concern. However, startups and entrepreneurs should take note of the dip in deals. This, coupled with the dire warnings of an imminent funding slowdown by investors, should be enough reason for entrepreneurs to begin tightening their belts.