ESOPs for Dummies: All about retention instruments for startups

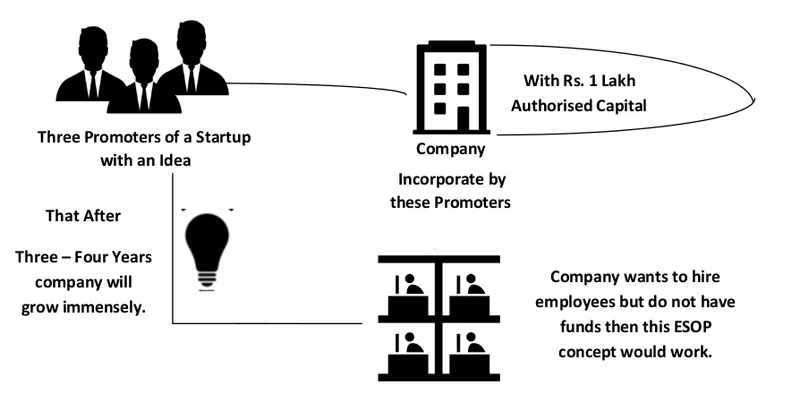

Last month, a startup came to us for company incorporation with three promoters in a state of India. They said they want to create an ESOP pool right then in order to offer Employee Stock Options (ESOPs) to their employees without knowing what ESOPs are and how they can be used to promote the startup. Let us understand this situation with the help of an info graphic:

Employee Stock Options were never as famous as they are now, thanks to all the startups who are putting in every effort to make their ventures successful. Traditionally, ESOPs were given to remunerate senior employees and to acknowledge their contribution to the company.

However, in modern times, ESOPs are used as a consideration by the founders as they can’t afford to shed a few thousand dollars in the beginning. ESOPs are also used to retain key employees in the organization.

But before coming to how startup should go for ESOPs we should understand:

What ESOPs are:

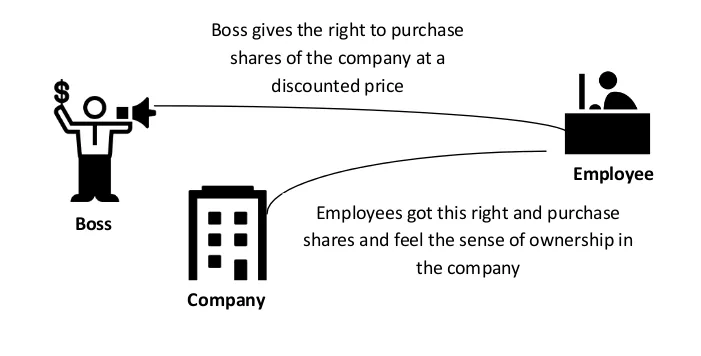

Employee Stock Option Plans are the plans in which employees get the right to purchase a number of shares (decided by the employer) in the company at a discounted price (less than the market price), on the basis of their performance. It is also meant to motivate employees to keep bettering their performance.

In this case, employees have to wait for a certain time period - known as vesting period - before they can exercise the right to purchase those specified number of shares.

Benefits of ESOPS

- Retainership instrument- ESOPs can be treated as a retainership instrument for small businesses as there is a lock in period for exercising the right to purchase the shares. Thus, a business can retain its employees. If an employee opts for this option then he has to serve the lock in period to become eligible to exercise it.

- Ownership feeling for employees-Getting shares of the company in which they are working gives employees an ownership feeling. They start feeling that they are not employees of the organisation but owners. Also, they get to share the profits of the company in the form of dividends and are motivated to work for the best of the company.

- Option in lieu of salary- Businesses that needs funds and are not in a position to spend hefty amounts can offer this option to their employees in lieu of salary and motivate them to work for the betterment of the company.

Dark side of ESOPs

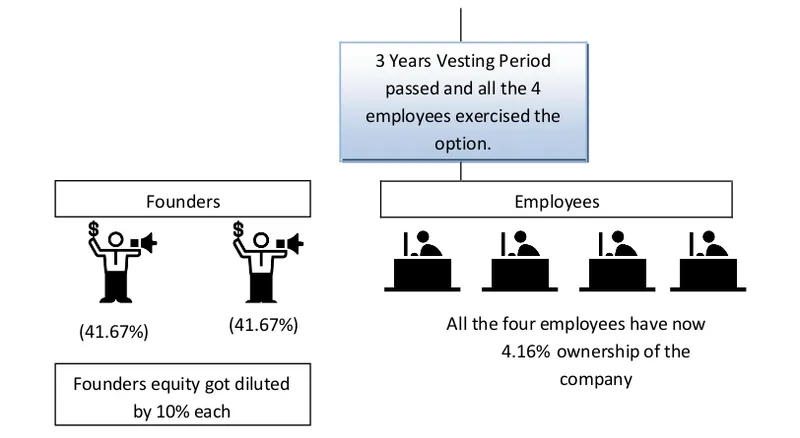

Just as every coin has two sides; ESOPs also have a darker side which is dilution. In other words, with every ESOP granted, the shareholding of the founders gets diluted. Let us understand the whole concept about ESOPs.

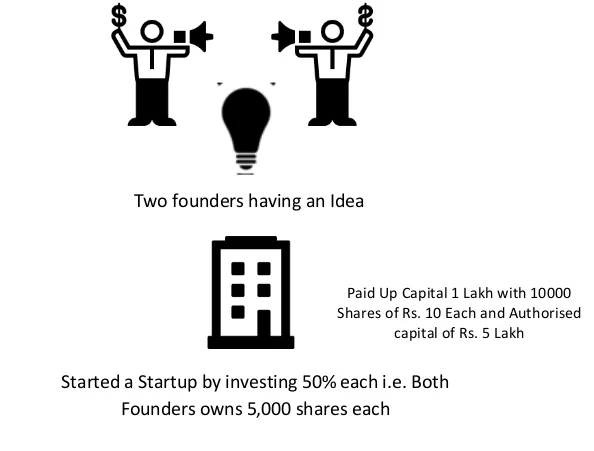

Now, they hire our employees and in the initial period give them Employee Stock Options (ESOPs) with a vesting period of three years giving an option to give 500 shares to each employee.

Conclusion

While established companies use this option as a retention tool for their top assets/brains; startups use it as a tool to hire talent, as they cannot afford to pay very high salaries. What makes an ESOP attractive, other than the value or potential value of the shares or units, is the idea of ownership it imparts to the employee holding it. However, the ESOP concept works only if the company is in a high-growth sector. Only then will the ESOPs see an actual rise in the value of the business.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)